Precision Trading for Professionals

Unlock the power of advanced trading

Leverage cutting-edge technology for your crypto trading success. Go beyond basic strategies by employing sophisticated tools, algorithms, and automations.

A powerful tool to enhance your trading activities

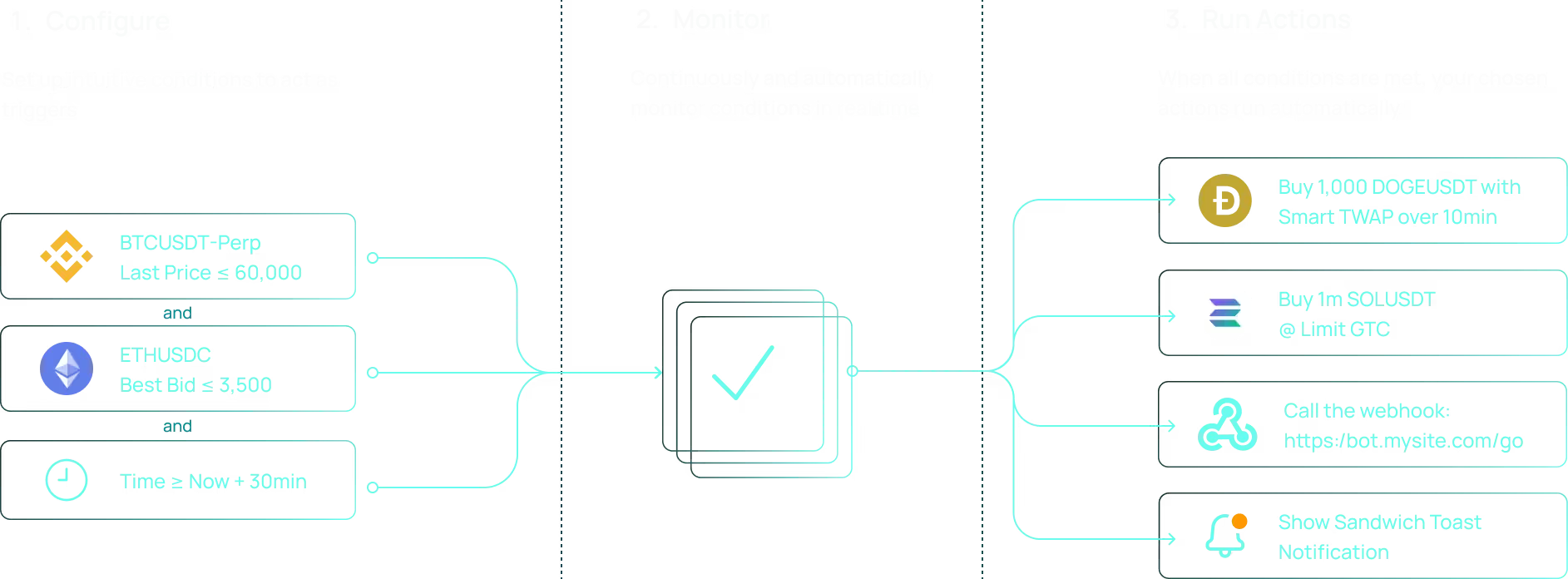

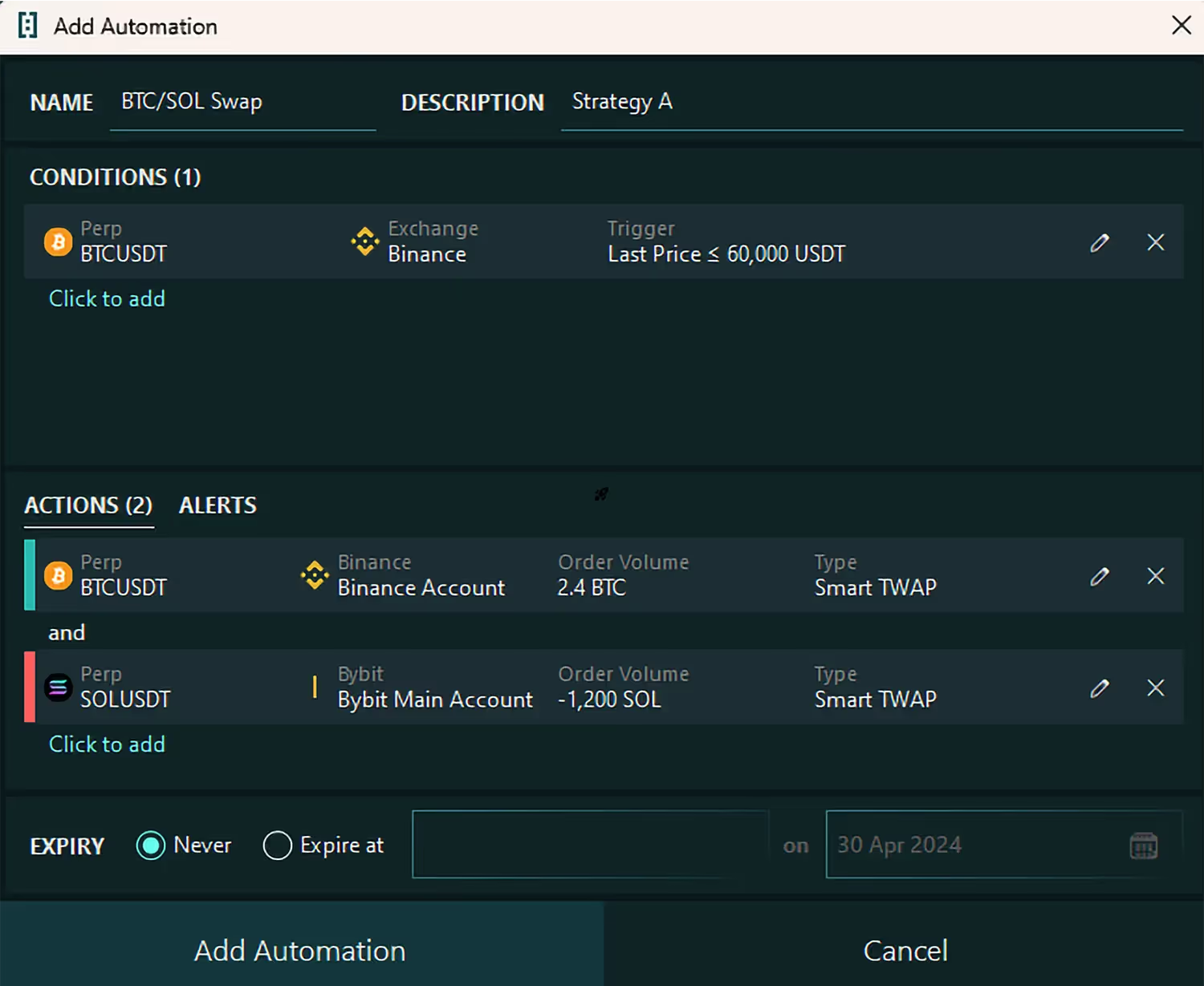

Why use automations?

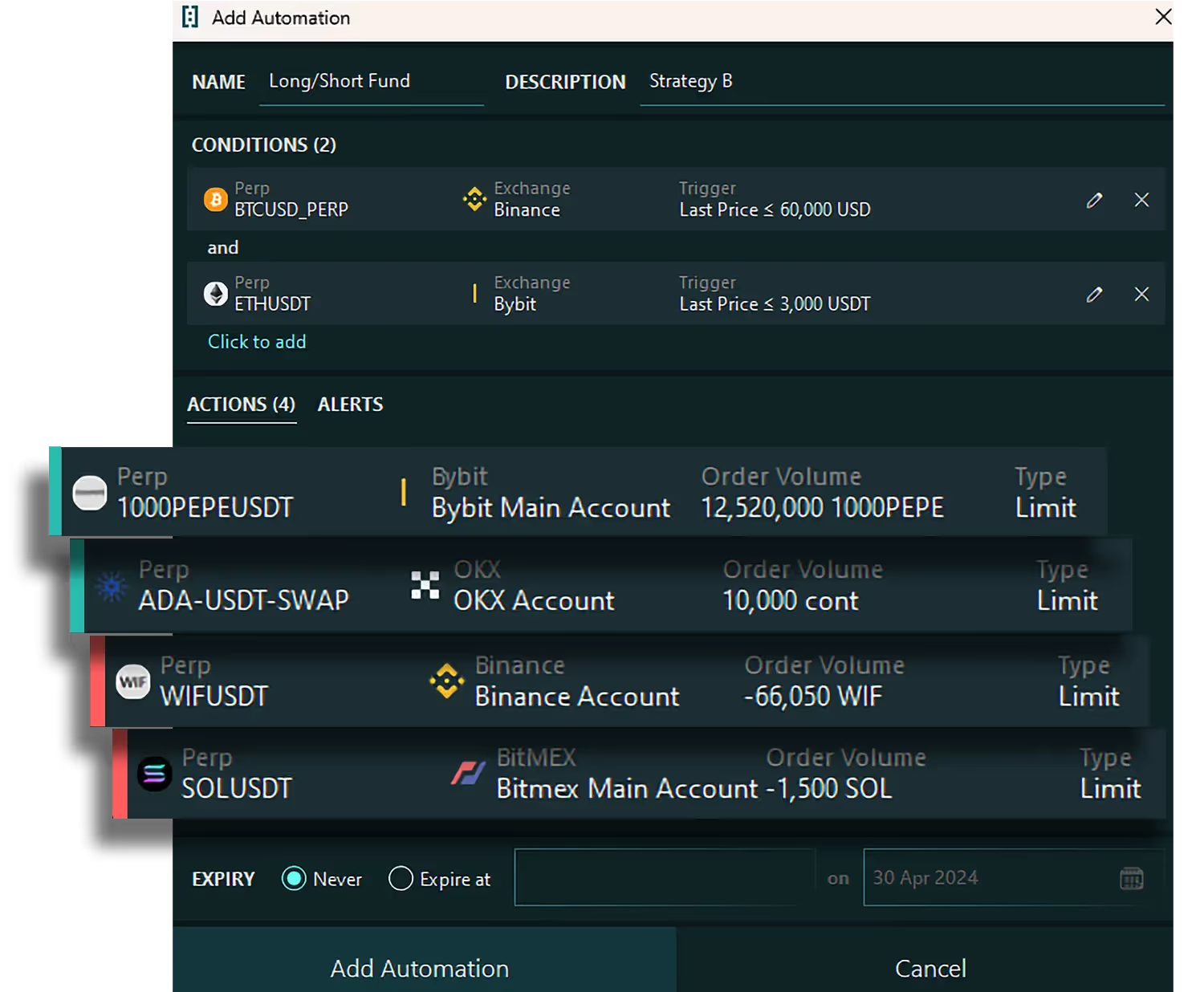

It allows manual and automated control of advanced and complex trading strategies.

The Automation Station keeps a continuous eye on the market for you so that you don't miss any opportunity.

Trade across multiple accounts, instruments and exchanges in a single click.

Whether to automate your trading strategy or manage orders efficiently, achieve trading excellence with the Automation Station.

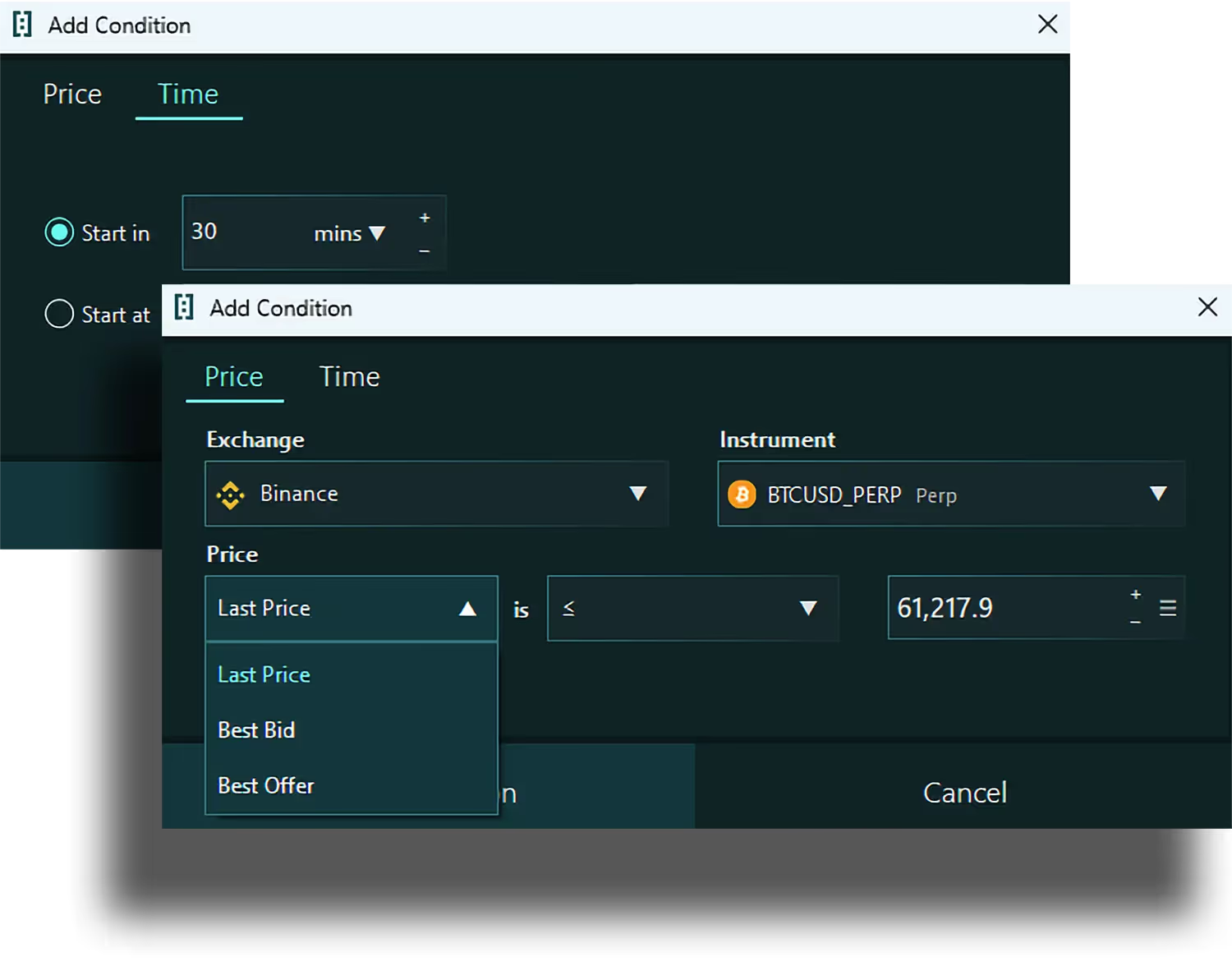

Intuitive UI

UI designed to instinctively add:

- Conditions

- Numerous Trade Actions

- Alerts

- Custom Webhooks

Time & Price based Conditions

Start your trading strategy by running the actions when:

- A specific time is met

- An instrument's price crosses a targeted level

- A combination of multiple Price and/or Time conditions are met

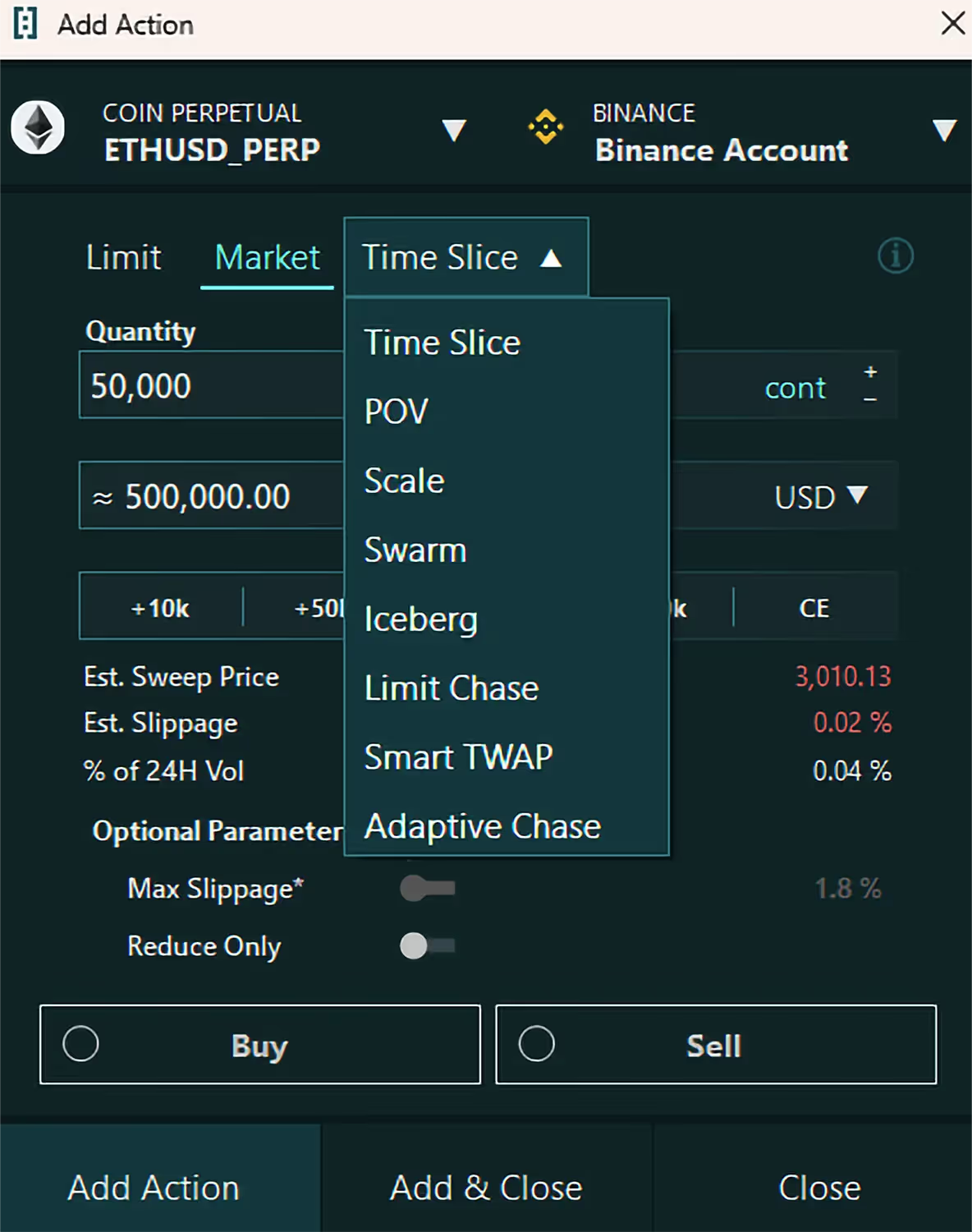

Add Actions - Any Actions

No restrictions on Order Types!

- Pick between Limit, Market or any of your favourite Algos

- Same familiar Order Ticket as what you've come to love on the DMA

Trade on Multiple Accounts & Instruments!

Want to trade across multiple exchanges and multiple instruments all at once? Done.

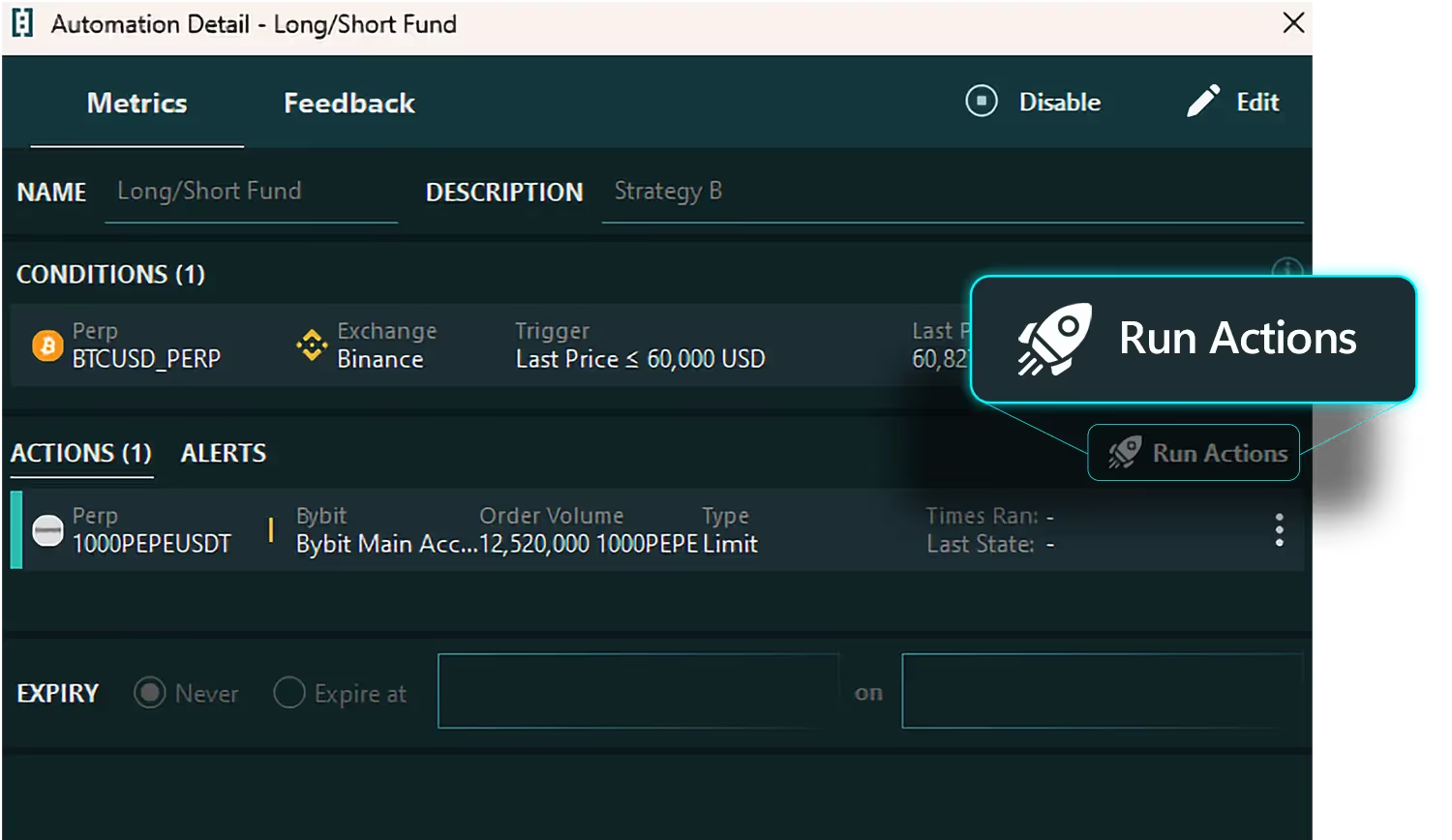

Manual Execution

Not ready to automate? No problem. Every automation allows you to manually trigger your trading Actions, giving you the flexibility to step in whenever you see fit.

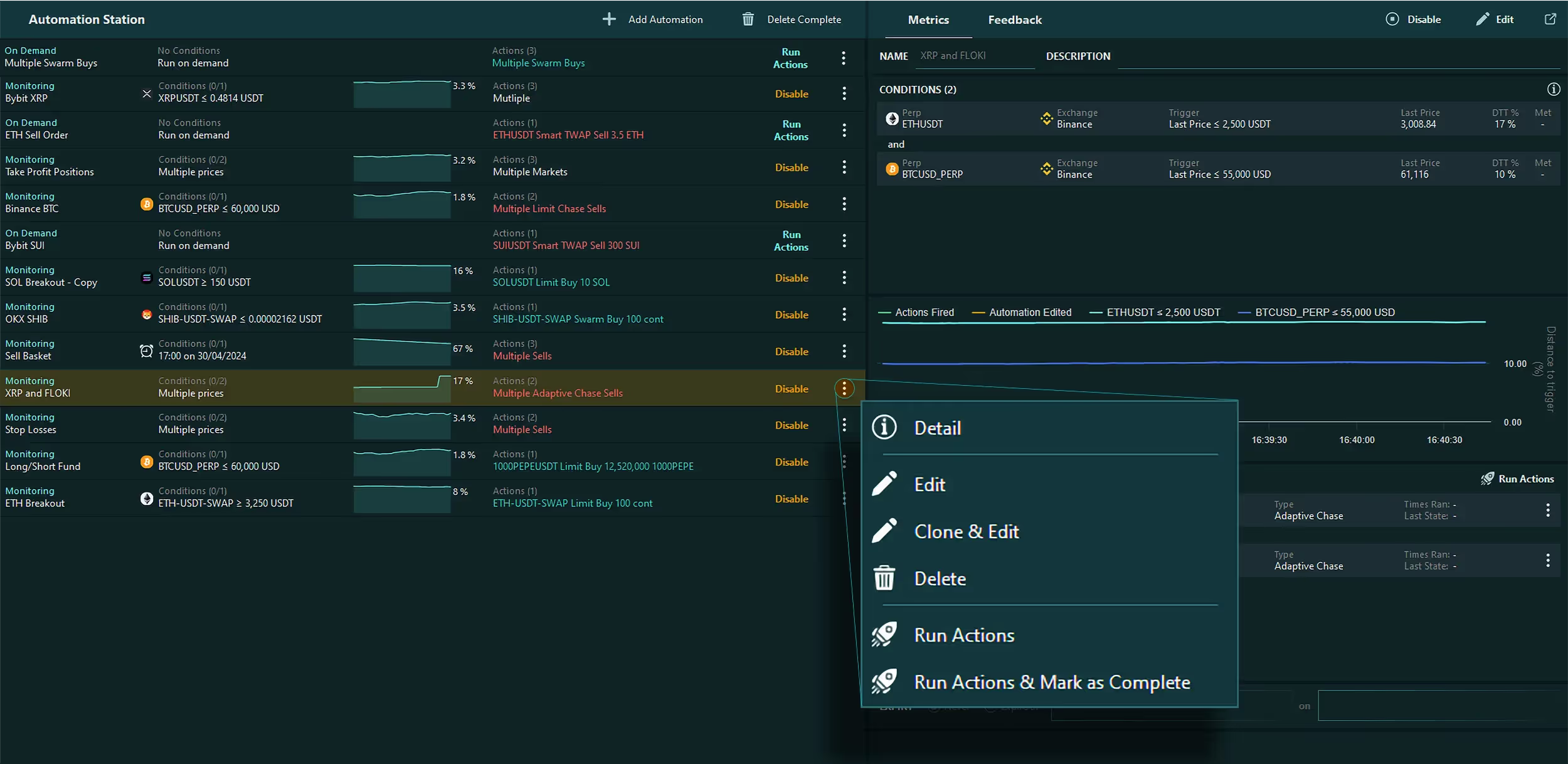

Powerful Automations Manager

As with the Algo Manager, the Automation Station provides a powerful interface to manage and inspect all of you running and historical automations.

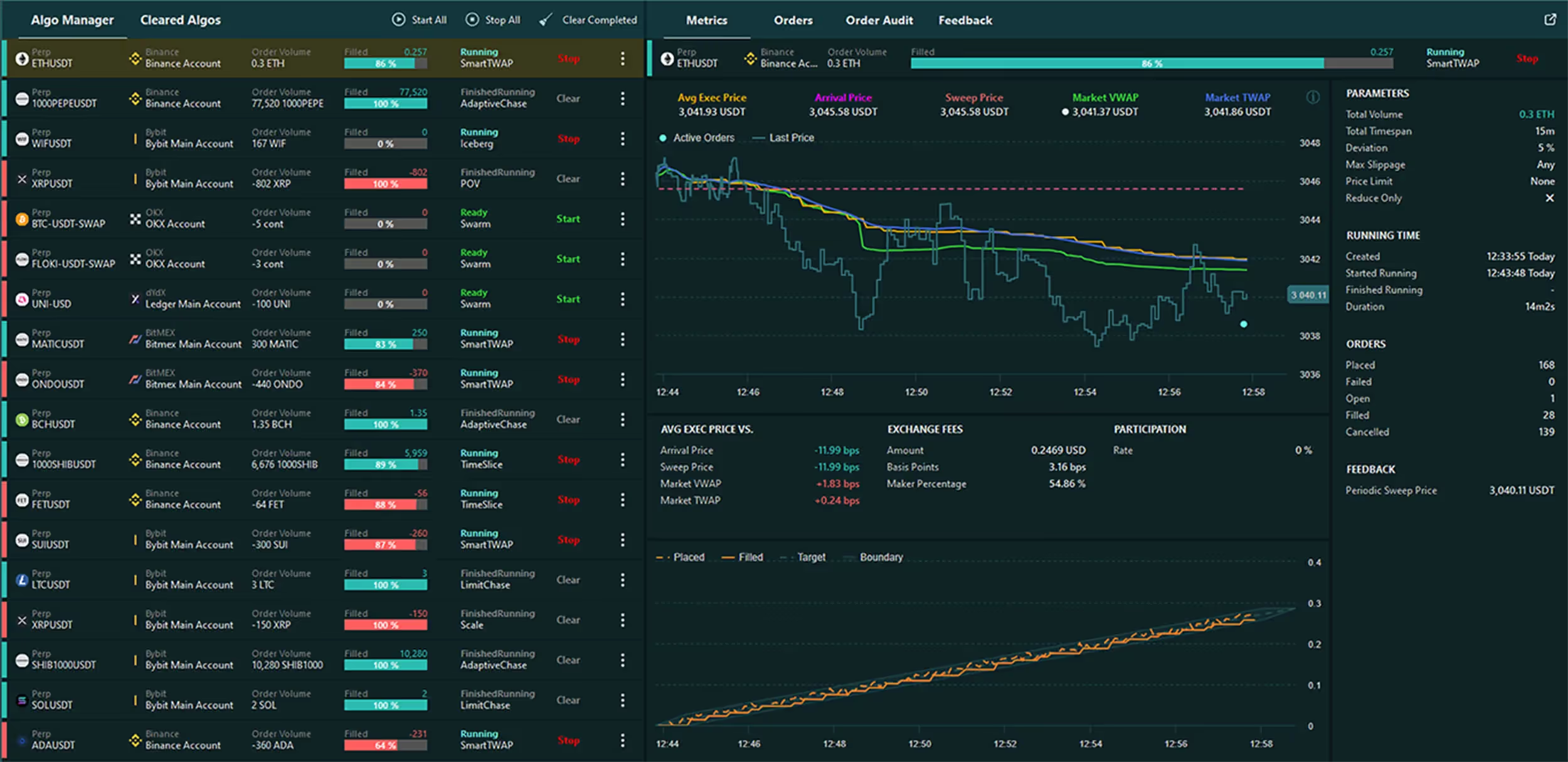

Monitor your algo trading across accounts and instruments with Sandwich Algo Manager

Start, Stop, and Queue Algos

This flexibility is crucial for adapting to changing market conditions or adjusting strategies based on performance.

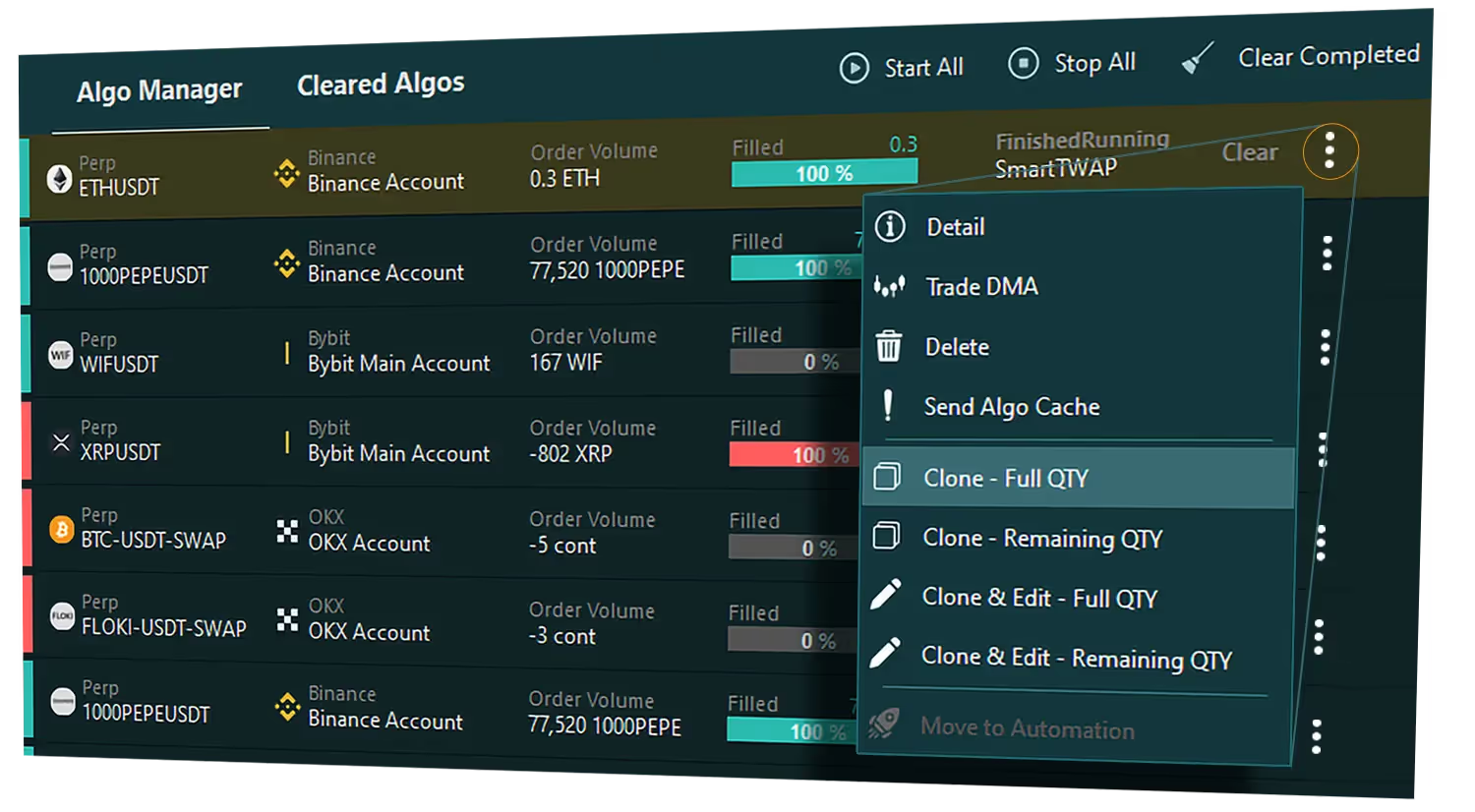

Algo Cloning and Editing

Cloning algos and being able to edit cloned algos saves time and allows for rapid deployment of successful strategies.

Algo Automation

Algos can be moved to the Automation Station, where they can be configured to run under specified conditions.

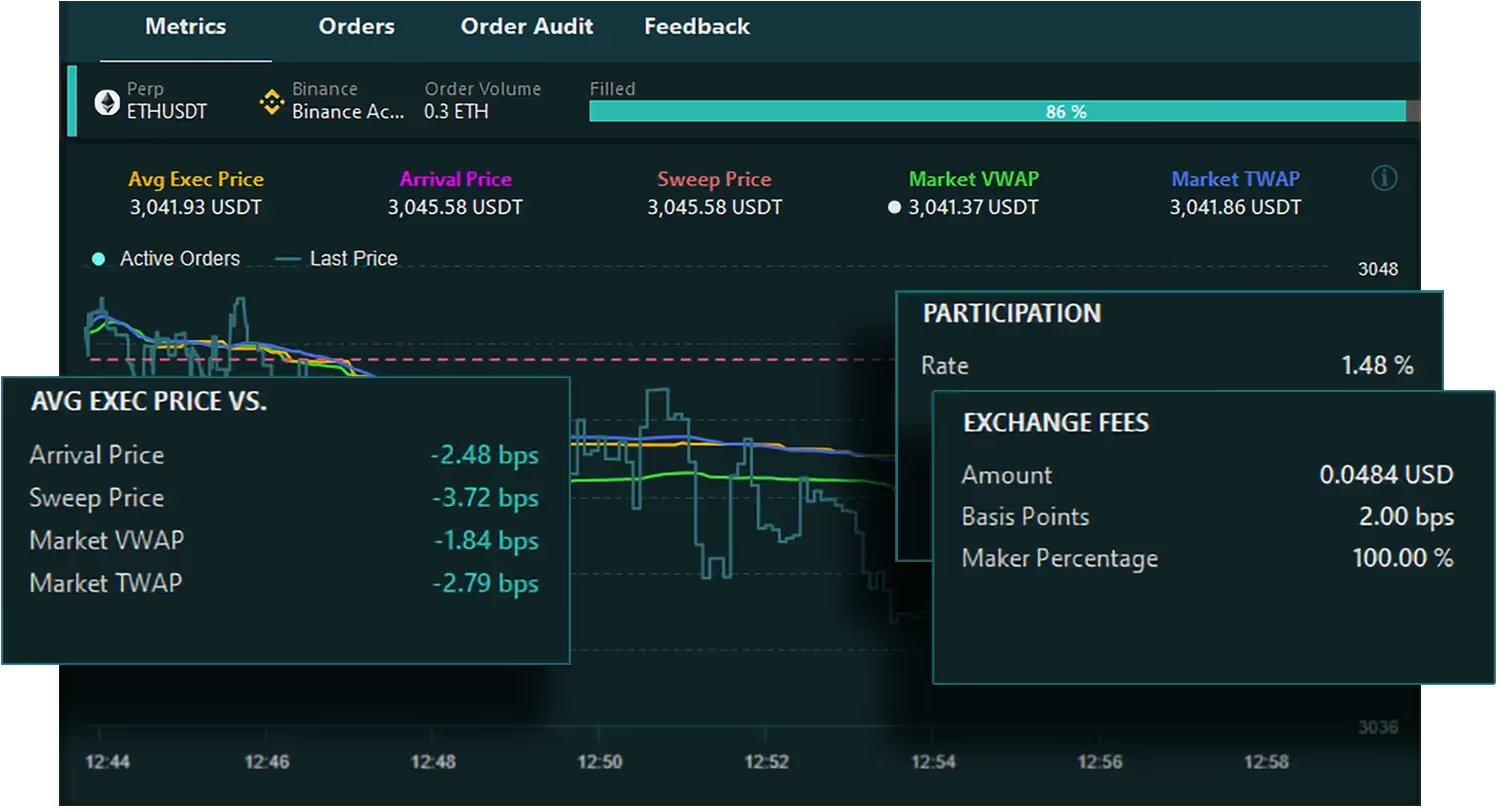

Real-Time and Post-Trade Performance Metrics

Metrics include execution comparisons against benchmarks like Market TWAP, Market VWAP and Arrival Price.

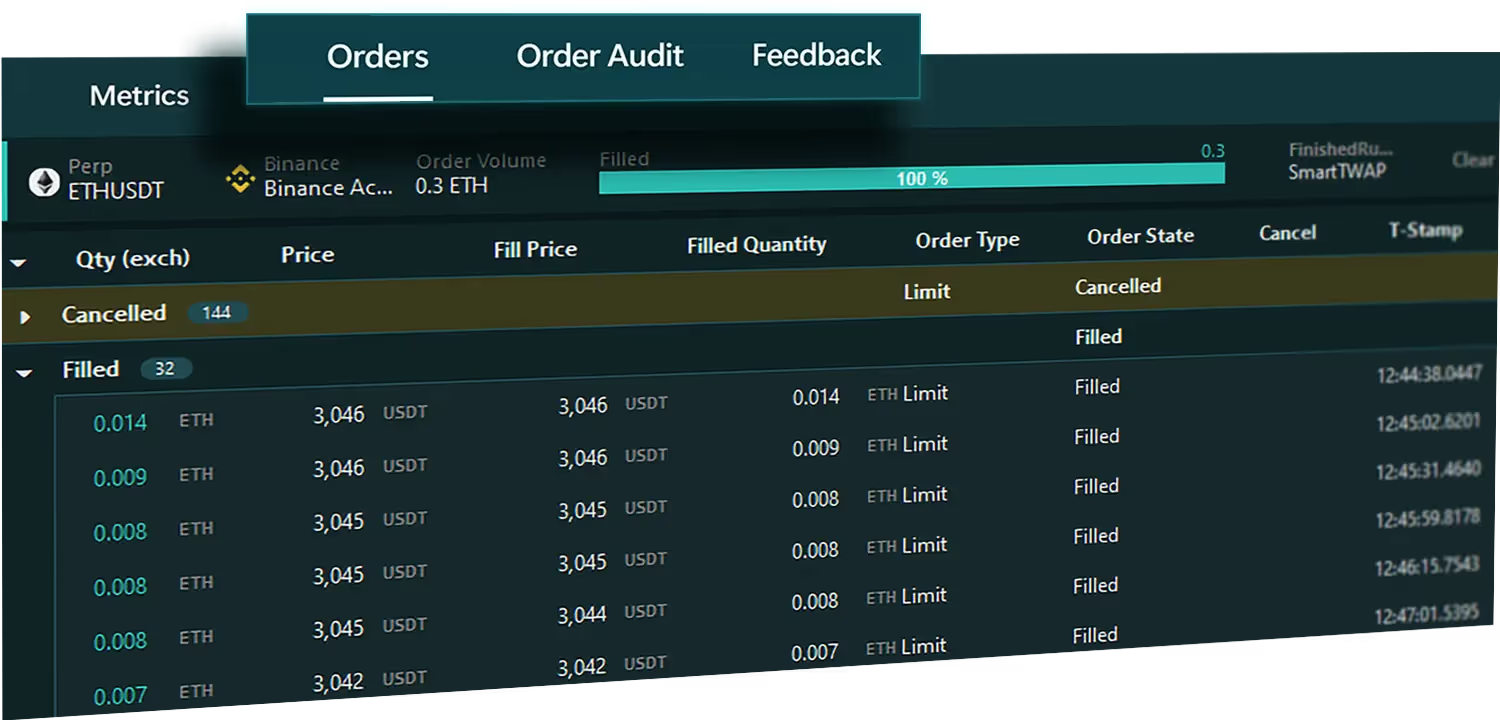

Monitoring Execution

Interested in the mechanics of these little machines? Peer under the hood for a comprehensive view of all the moving parts.

- Orders: A digestible view of all cancelled, filled and active orders.

- Order Audit: See single order progression from placement to completion.

- Feedback: For detailed logs and insights into the algo decisions.

The wonder of algorithmic trading

Time Slice

The Time Slice algo splits large orders into smaller ones over a set period, reducing market impact by dispersing the execution.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

POV

The POV algo executes large orders in parts, targeting a user-set share of market volume over time, aiming to reduce market impact.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

Scale

The Scale algo sets multiple limit orders within a chosen price range, allowing users to tweak the price distribution factor.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

Swarm

The Swarm algo breaks a large order into smaller market orders to minimize slippage and market visibility.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

Iceberg

The Iceberg algo divides a large order into smaller limit orders to conceal the total order size from the market.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

Limit Chase

The Limit Chase algo sets a limit order at a defined Chase Distance from the best bid or offer and adjusts to stay within this maximum distance.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

Smart TWAP

The Smart TWAP algo aims for an average execution price close to the market's TWAP, reducing market impact, saving costs, and minimizing tracking risk.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

Adaptive Chase

The Adaptive Chase algo, aiming for liquidity at optimal prices and lower trading fees, calculates a reference price from a specified order book chase distance for execution.

Size Randomness

Price Limit

Interval Randomness

Reduce Only

Post Only

Price Distribution

Max Slippage

Aggression Level

Why use Sandwich's Algos?

The algos come paired with a very powerful Algo Manager to manage multiple algos at once

Want to run an algo once a range of price triggers are met, you can do that with our robust and very capable Automation Station

These algos have been put through their paces both in testing and in production.

Algos designed to meet the demands of institutional traders, offering robust, reliable, and scalable trading solutions.

DOM Trader

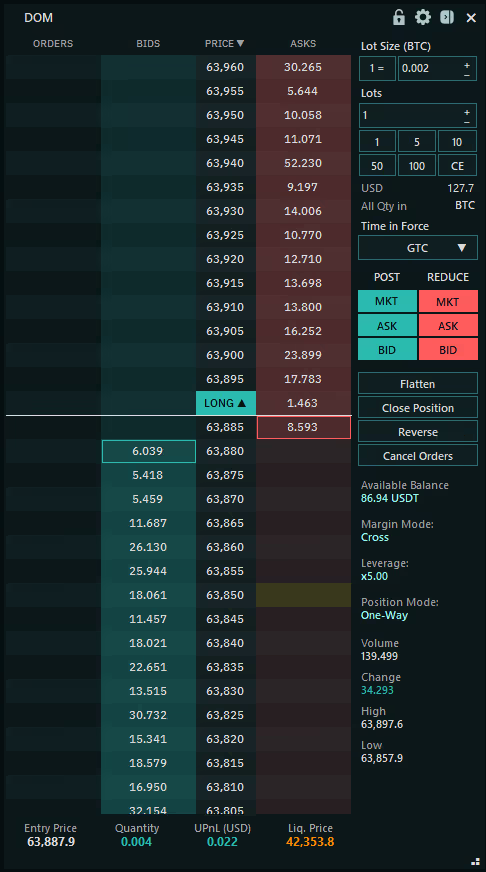

Understanding the DOM Trader Layout

Columns

Orders Column:

Shows your buy and sell orders at each price level.

Bids Column:

Displayed on the left side of the price column, shows the total quantity bid at each price level.

Price Column:

This central column displays different price levels for the selected Instrument.

Asks Column:

Displayed on the right side of the price column, shows the total quantity on offer at each price level.

Order Entry Panel

Customise your order parameters.

Customisable Lots Size settings per instrument that will be persisted across sessions

Quick Entry Buttons for number of Lots to trade

View Total Order Size in User Currency

Toggle between viewing all quantities in default instrument currency or lot size

Select Time in Force for your order

Select Post or Reduce if applicable

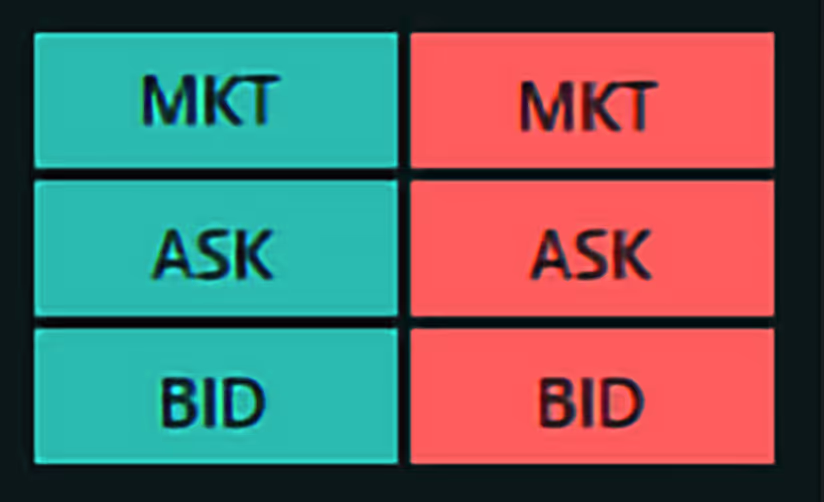

Quick Trade Buttons

Quickly place Market orders, or Limit orders at the Ask or Bid Price

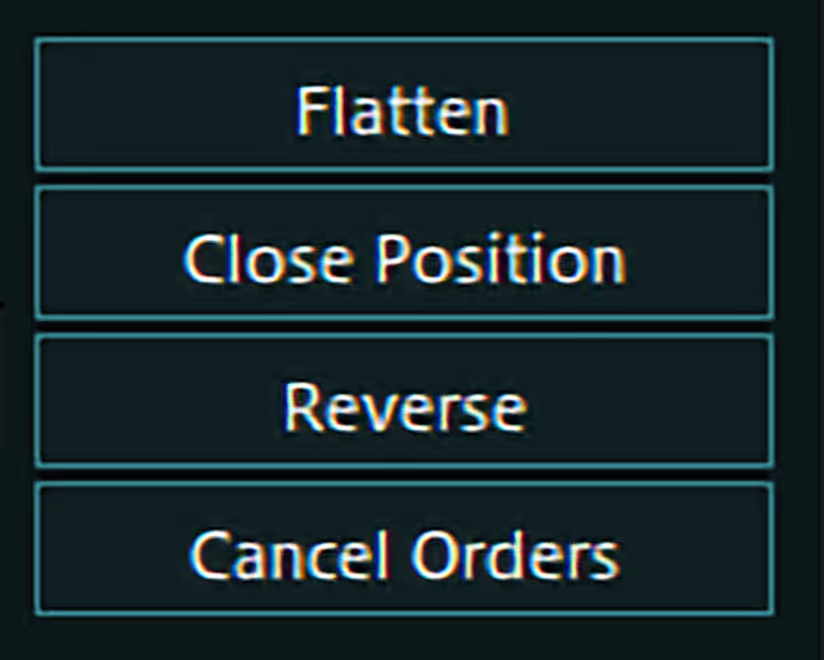

Orders & Positions Management

Flatten: Close all Positions and cancel open Orders

Close: Close all Positions

Reverse: Reverse all existing Positions

Cancel Orders: Cancel all open Orders

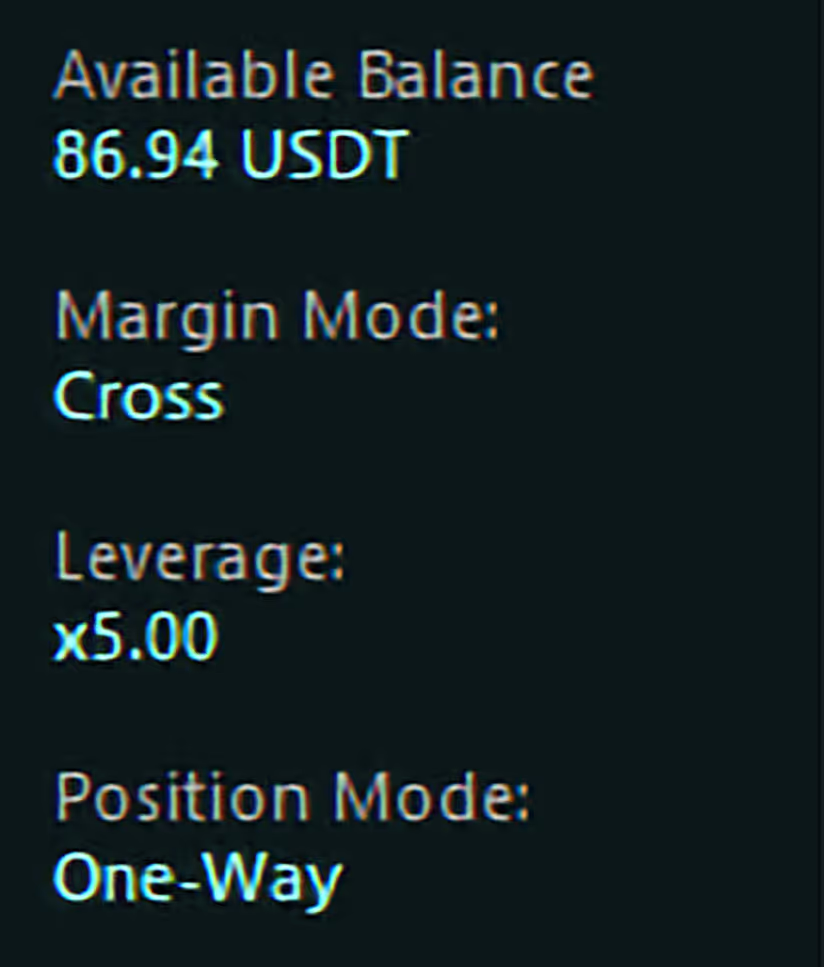

User Account Instrument Information

Click values to adjust account instrument settings

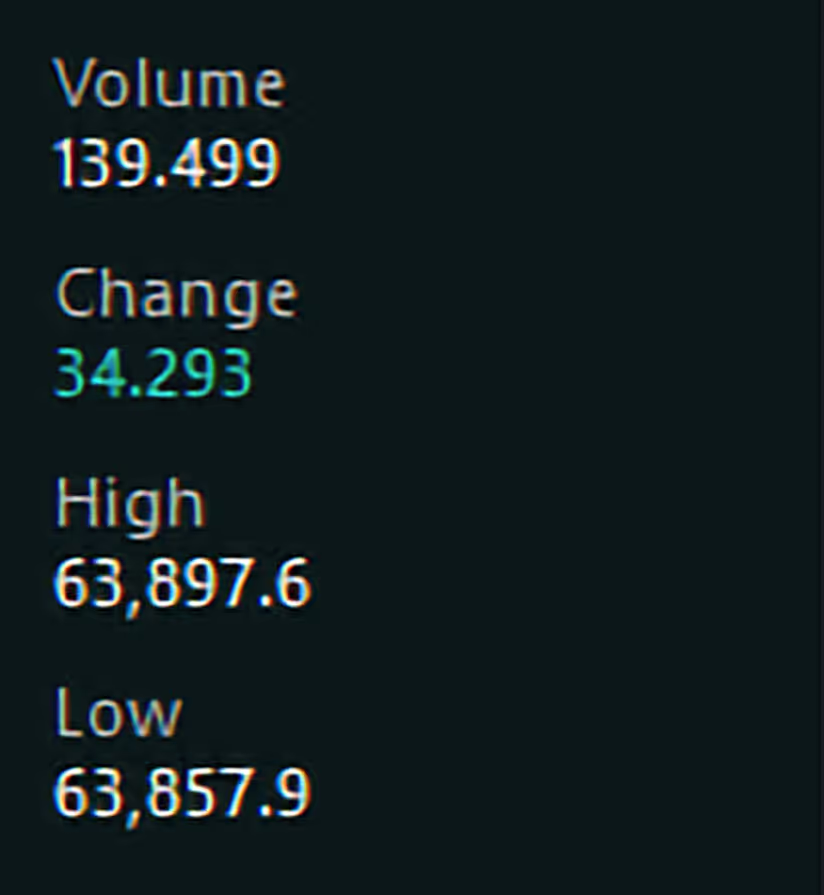

Instrument Session Metadata

Volume: Total Volume Traded In Rolling Volume Period

Change: Nett Buys / Sells In Rolling Volume Period

High: Session High Price

Low: Session Low Price

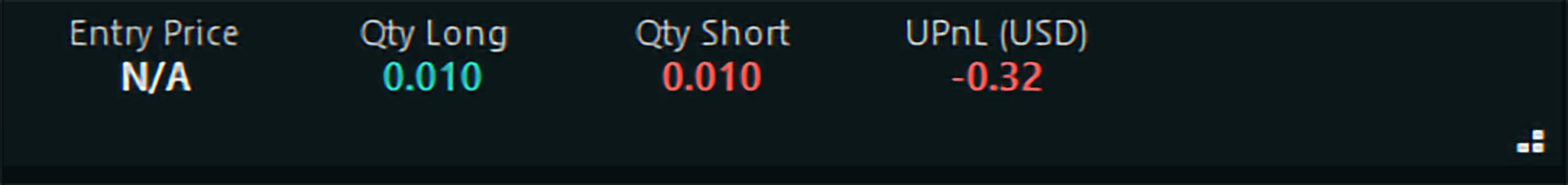

Positions Bar

Summary of your positions for the selected Instrument.

In One-Way Mode:

Entry Price, Quantity, UPnL (User Currency), Liquidation Price

In Hedge Mode:

Entry Price, Quantity Long, Quantity Short, Nett UPnL (User Currency)

Mouse Trading Feature

An interactive way to quickly place, modify, and cancel orders directly within the DOM.

Single Click to buy or sell on the desired price level in the Bids or Asks columns.

Drag-and-Drop existing orders to change them to a new price level. When amending multiple orders at the same price level by dragging-and-dropping, orders are aggregated to a single order at the specified price level. The remaining orders will be canceled to save on Rate Limits.

Right-Click to Cancel: Cancel any orders at the desired price level by Right-Clicking on the orders.

Right-Click on Price Column to reset the reference price to the current midprice and bring it into view.

Hold Ctrl + Scroll to increase / decrease selected price grouping increment

DOM Menu & Settings

Click on the Icons to set the following from the Taskbar:

Padlock: Lock to Midprice

(Also accessible in DOM Settings)

Gear: Display DOM Settings

Panel: Hide / Show Side Panel

Mid Price: Lock view to the market Mid Price

Show Quantities: with respect to the chosen lot size

Abbreviated Quantities: Reduce the number of digits in the Bid / Ask columns

Algo Orders: View only

Volume Columns: Toggle to show amounts bought and sold

VWAP: Display for session

Profile Period: Session duration will affect the display of volume metrics

Grouping: Aggregate orders into groups according to their price levels

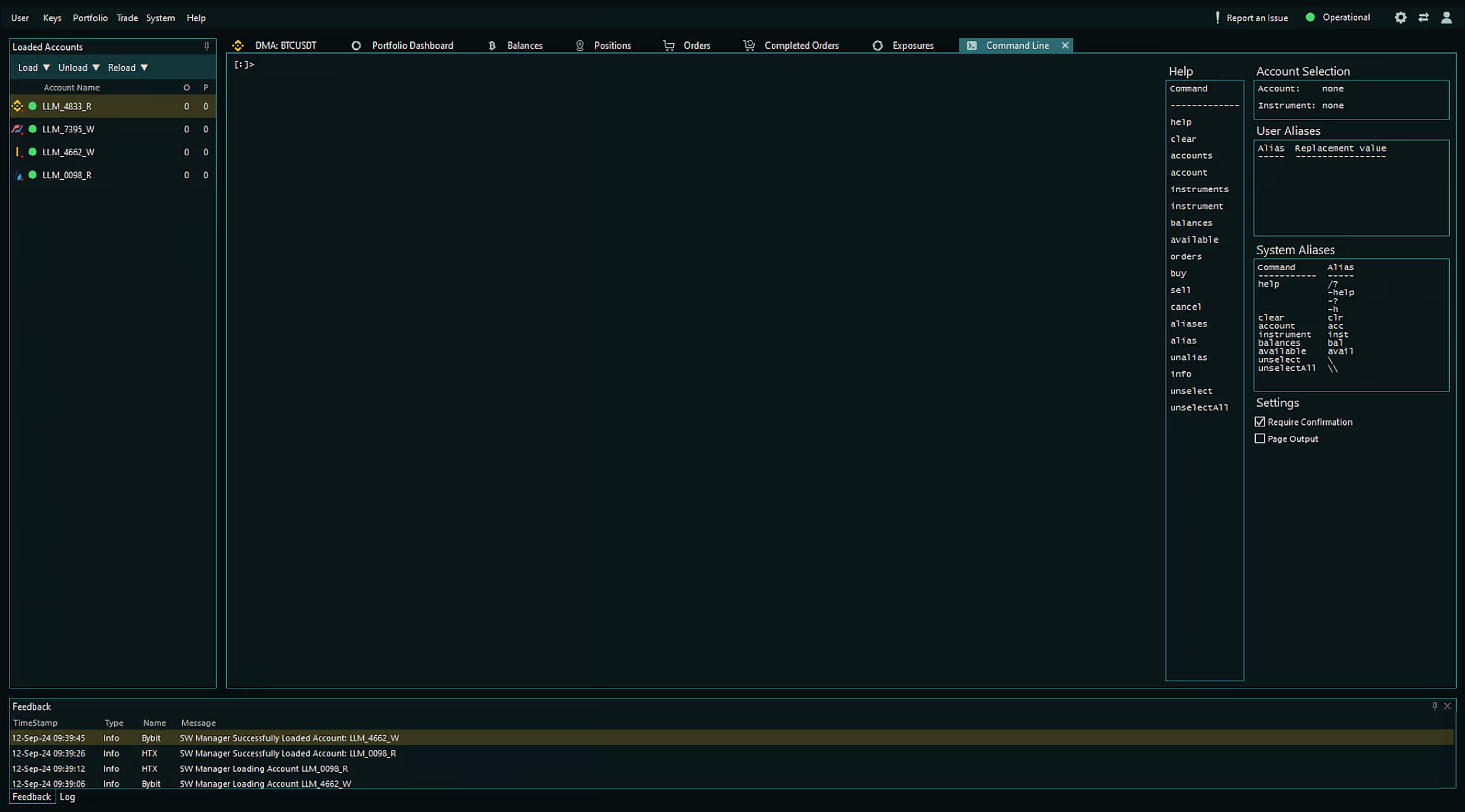

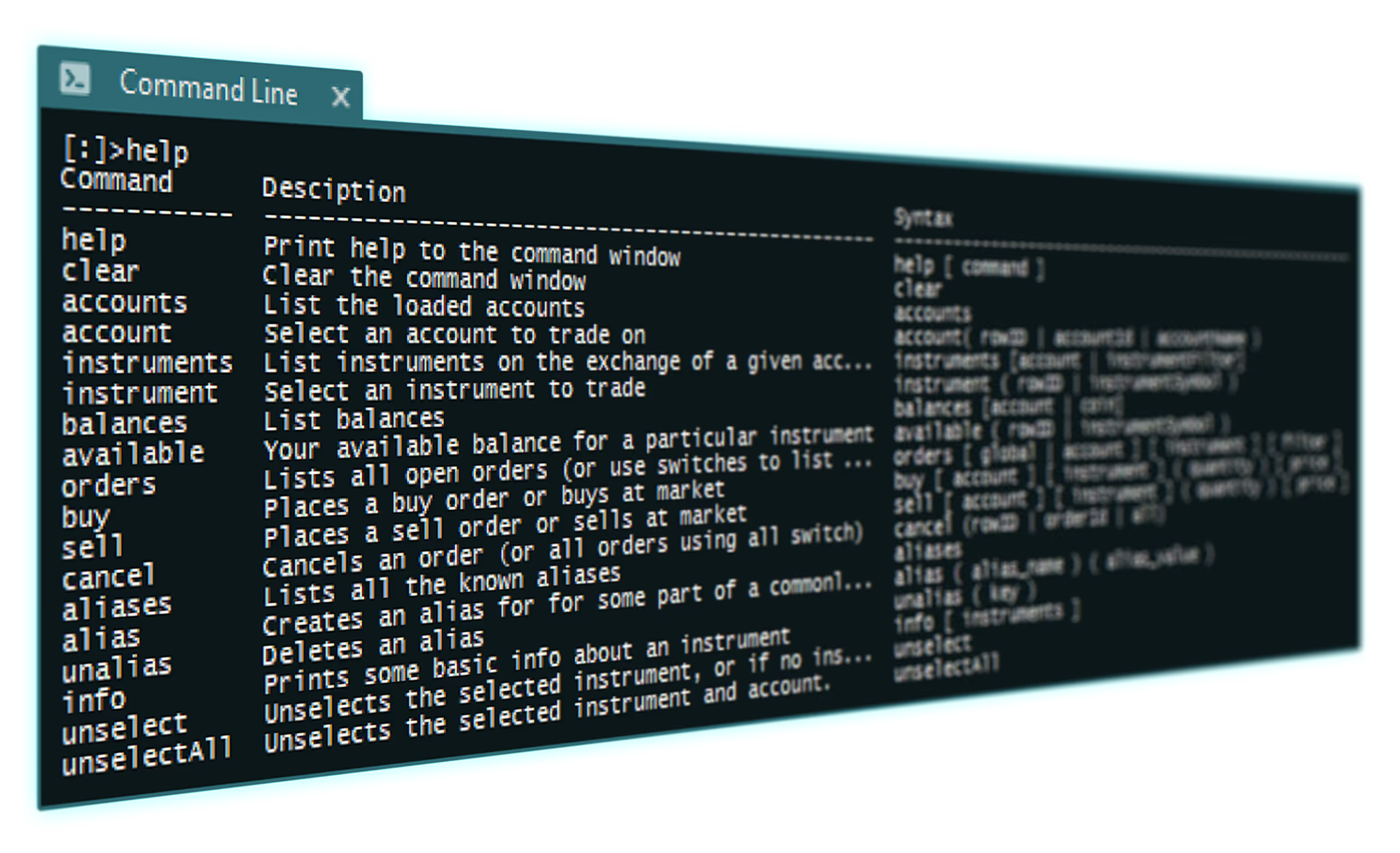

Say hello to CLI

Experience the Power of CLI Trading at Your Fingertips

- Modify buy, sell, or cancel commands

- Confirm and execute buy or sell ordersSeamlessly amend or cancel trades without leaving the CLI

- Check Account Balances

- View Positions

- Manage Orders

- Requires fewer system resources to implement

- Automation of repetitive tasks is simplified by line editing and history mechanisms for storing frequently used sequences.

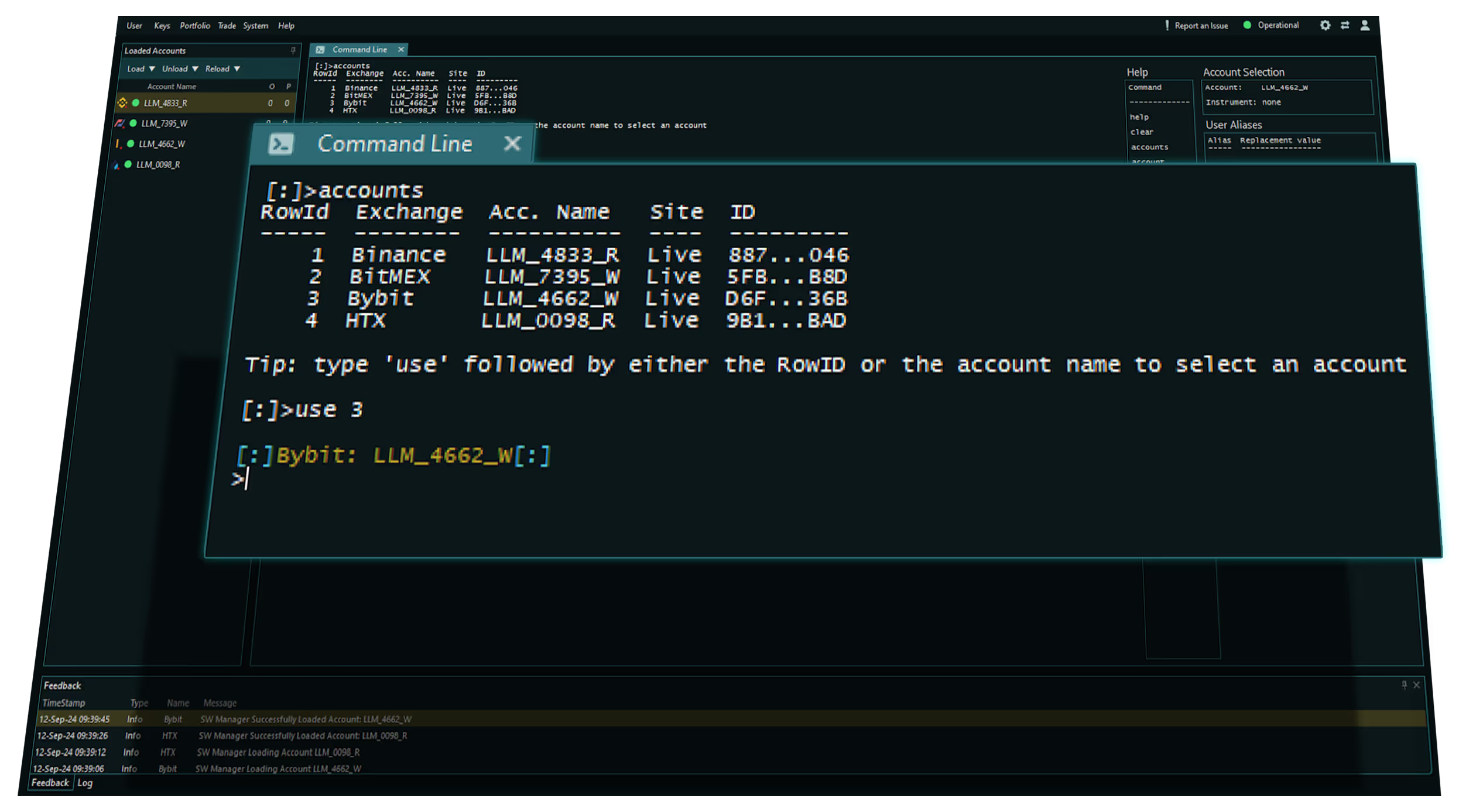

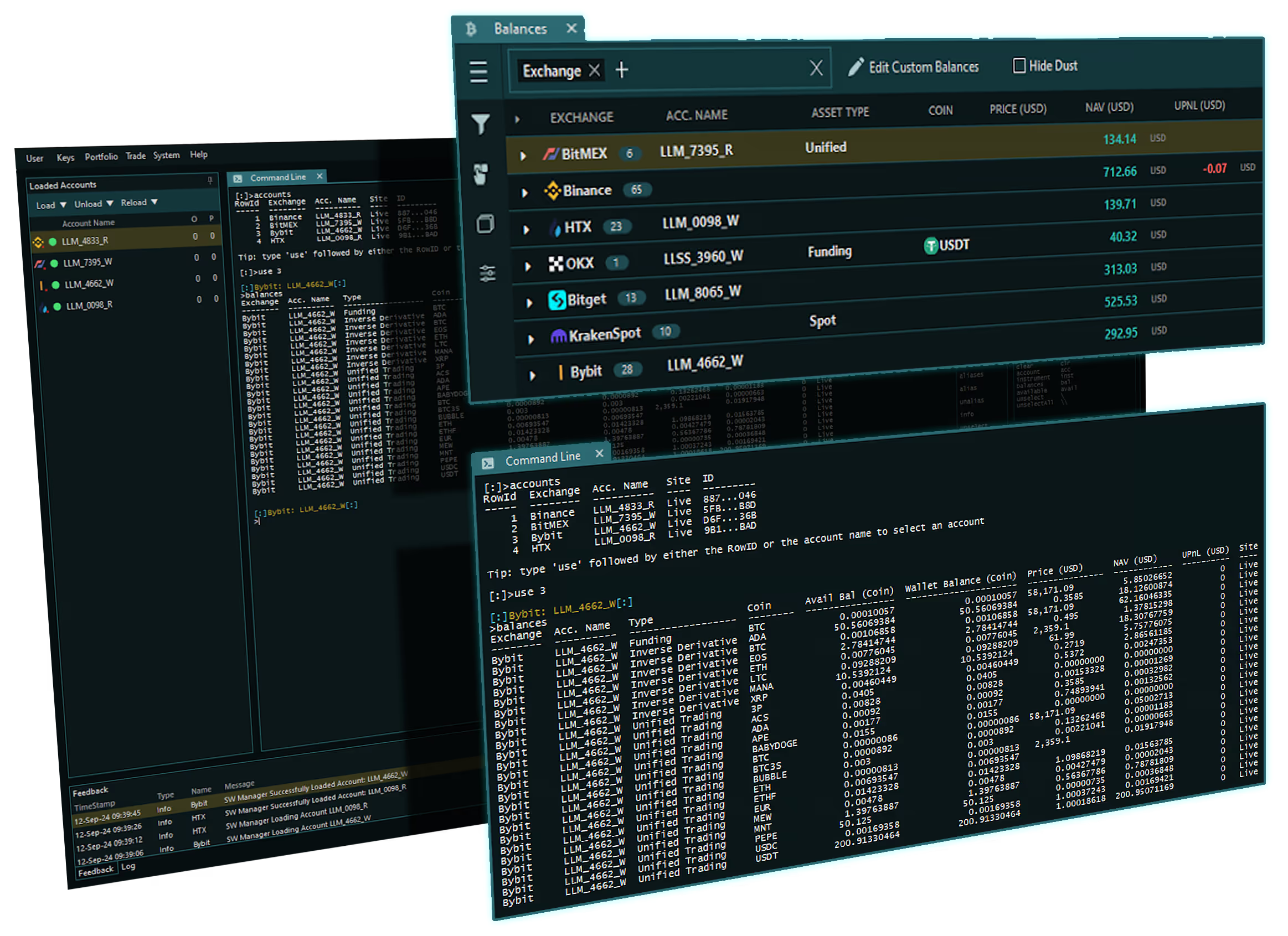

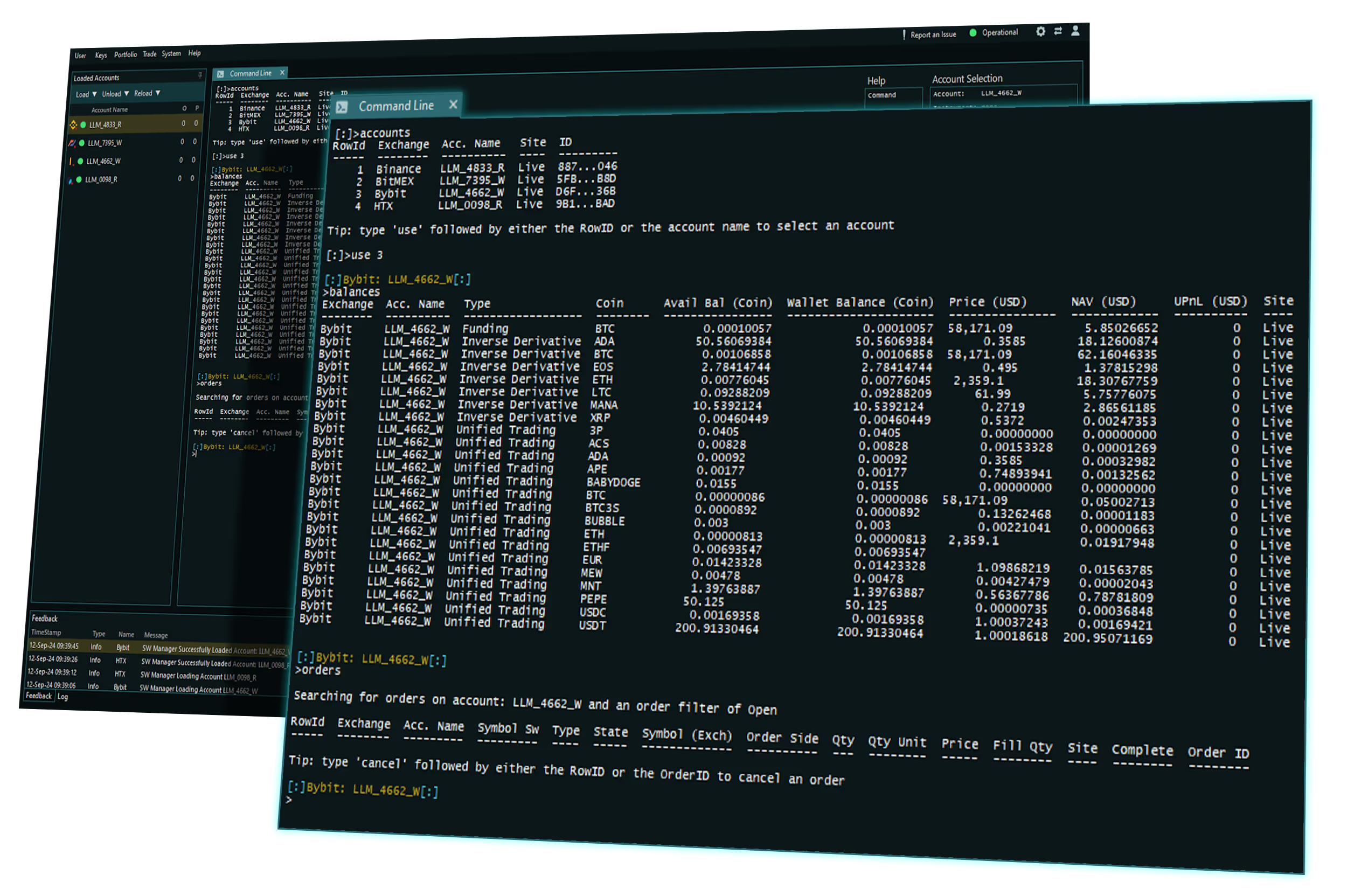

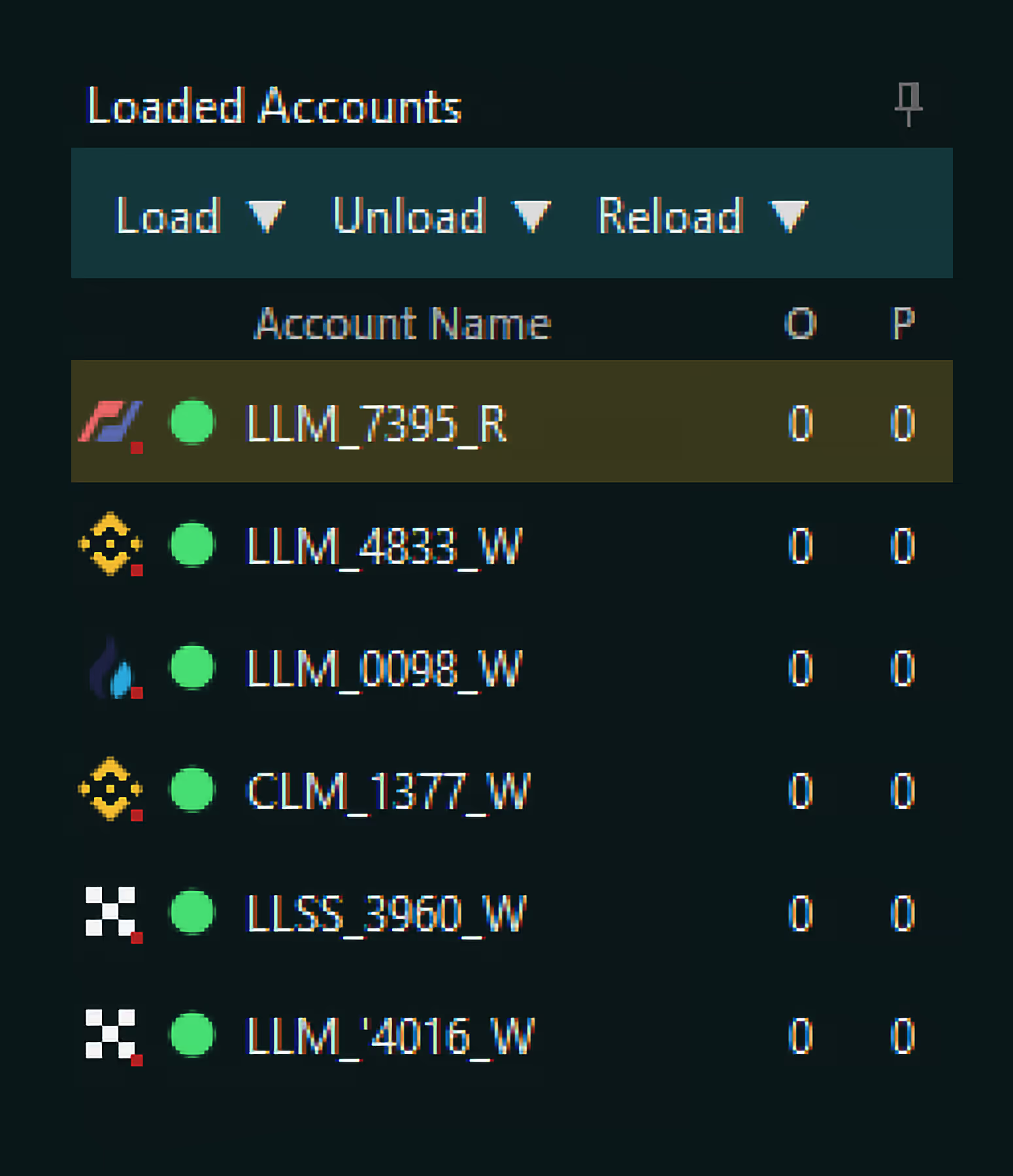

View & Select Loaded Accounts

View Account Balances

View Open Orders

Command Reference Guide

Simply type "help" to open this guide.

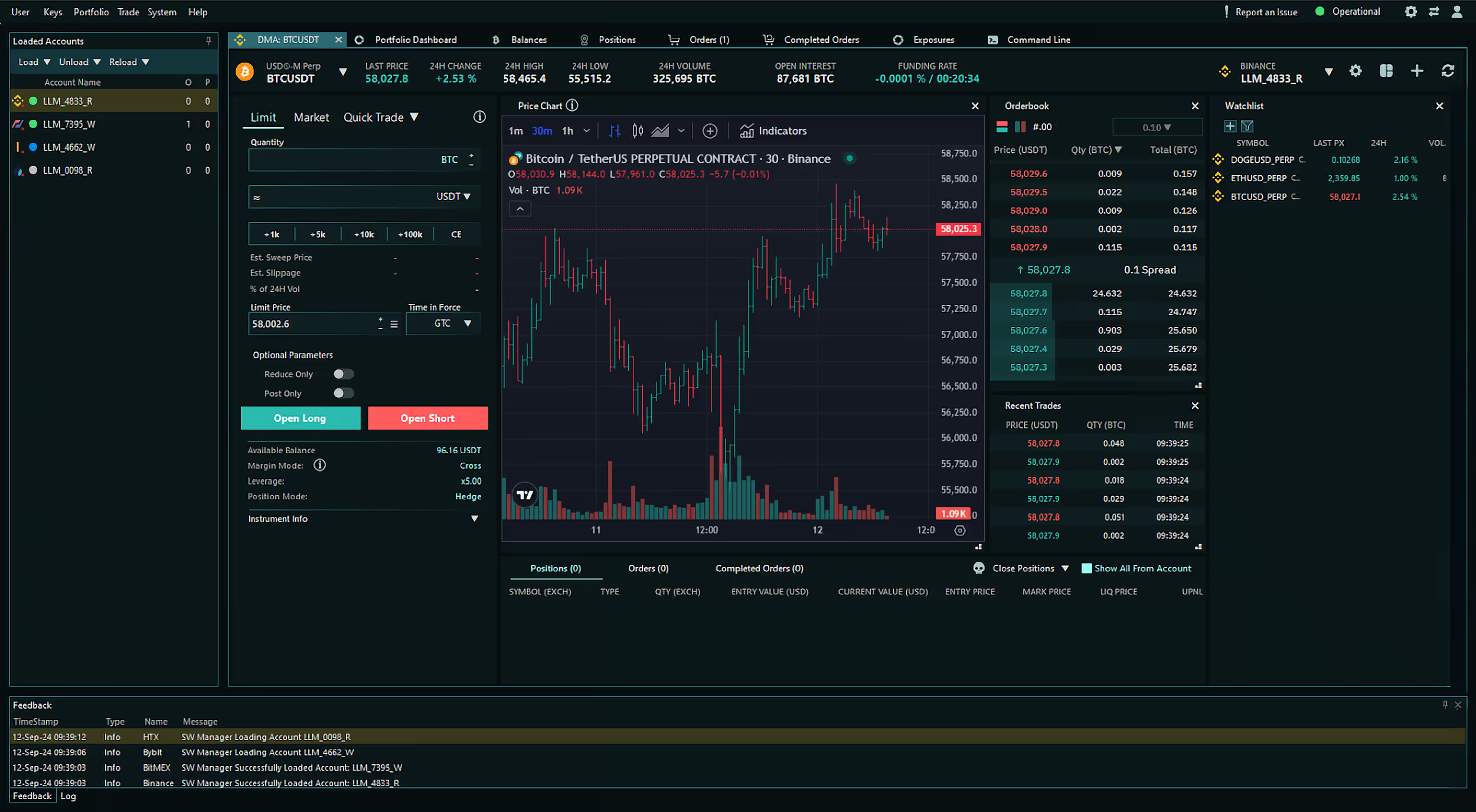

DMA Trading:

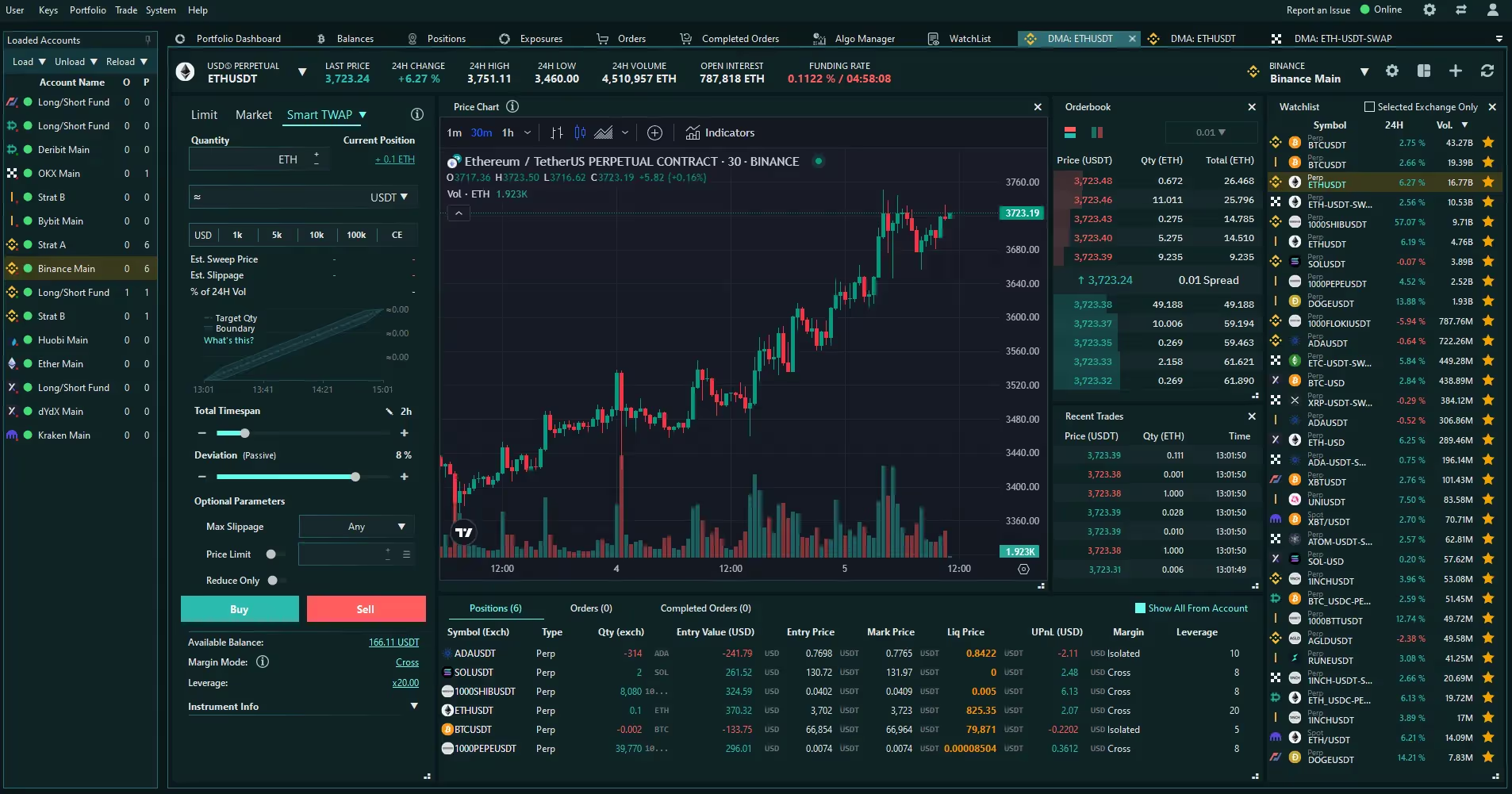

The Market at your fingertips.

What is DMA Trading?

Why DMA?

Execute large trades with minimal slippage and faster execution, even in the most volatile markets. Reduce the time taken for trades to execute.

Automate your trading processes and execute orders based on predefined parameters and market conditions.

Whether you're monitoring liquidity, tracking market sentiment, identifying large orders, or planning entry and exit points, the enhanced visibility of order book data provides real-time insights into market depth.

DMA's Anatomy

Order Book

The heart of any DMA trading screen, providing real-time access to the buy and sell orders on various exchanges.

Customizable Quantities:

Order book quantities can be viewed in terms of base, quote or user-currency values, giving users a better grasp of current liquidity.

Market Depth:

Traders can view the depth of liquidity at each price level, helping them determine the best points to enter or exit trades.

Recent Trades

A real-time record of executed transactions.

Execution Speed:

Shows trades happening in real-time, including the price and volume of each transaction.

Trade Flow Analysis:

Traders can analyze whether large buyers or sellers are entering the market, giving them insight into the current market momentum.

Watchlist

Personalize your list of cryptocurrencies on the various exchanges to keep a close eye on.

Multi-Market Overview:

Track multiple assets across various exchanges, giving you a broad overview of opportunities without having to jump between screens.

Real-Time Data:

Watchlists update in real-time, showing the latest price, 24-hour price percentage change and volume for your chosen assets.

Price Chart

Graphical representation of an asset’s price movements over time.

Customizable Indicators:

Overlay advanced technical indicators.

Real-Time Updates:

Current view of market trends, patterns and breakouts.

Multiple Timeframes:

Switch between different timeframes (minutes, hours, days) to analyze short-term and long-term trends simultaneously.

Why stop at one market when you can watch them all?

By using multiple DMA windows, advanced traders can monitor various exchanges and markets at the same time.The more eyes you have on the market, the more chance you have to seize the moment.

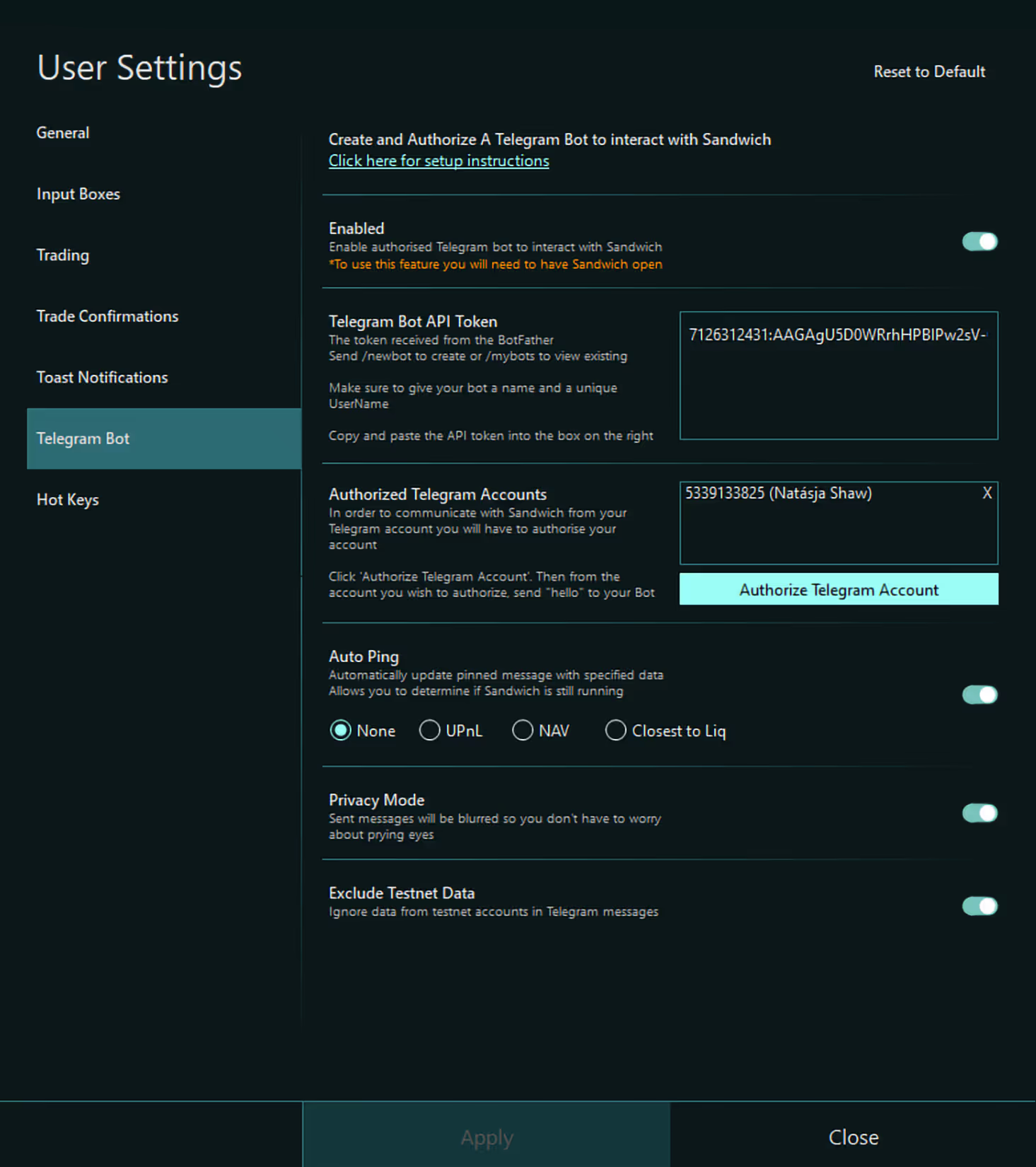

Seamless Portfolio Insights with Telegram

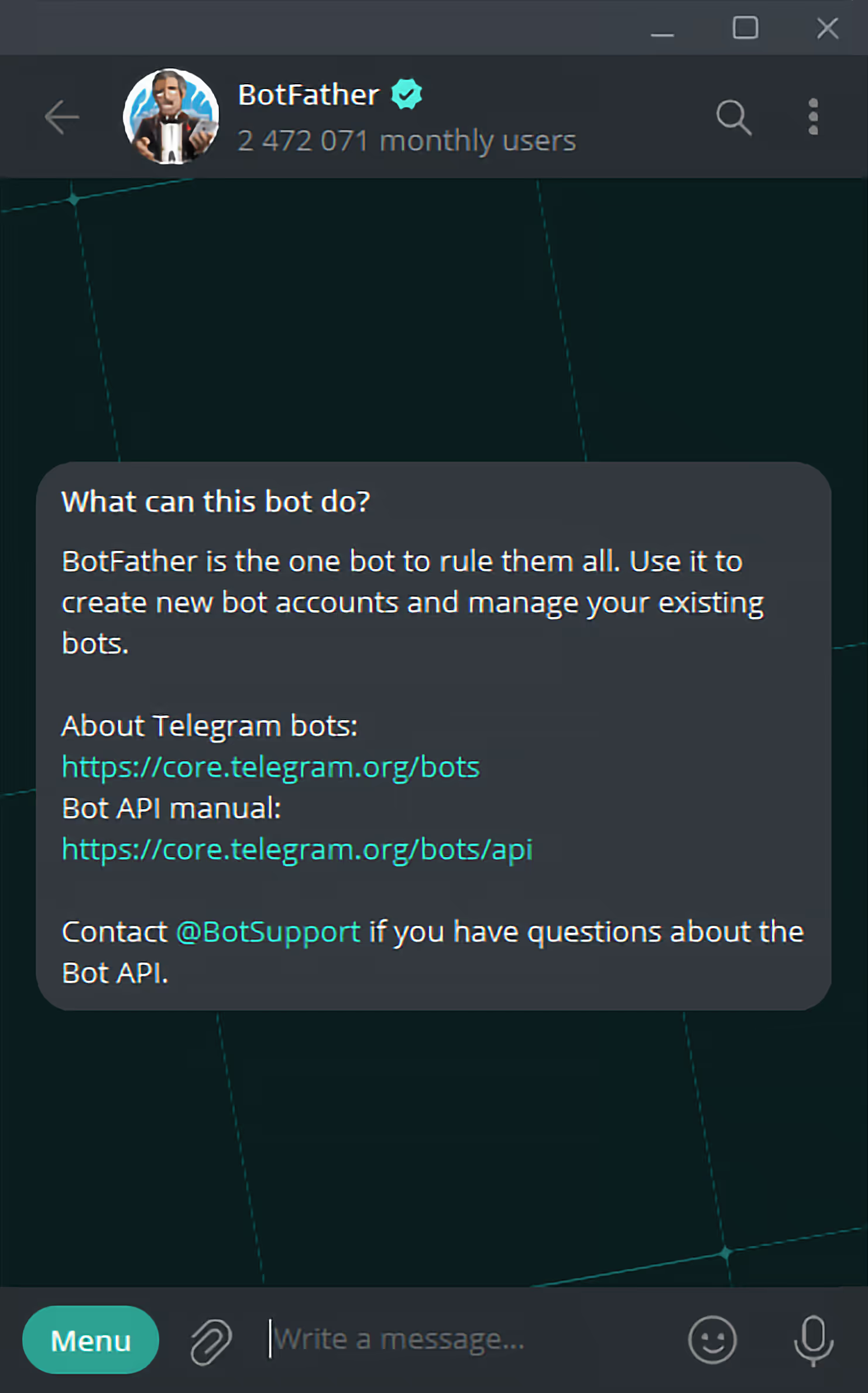

Intergrate in a few easy steps

1. In Telegram

2. In Sandwich

Advanced Portfolio Management in Sandwich

Sandwich's portfolio dashboard gives you a bird's-eye view of your assets.

Managing risk across multiple exchanges and assets and real-time portfolio tracking is critical to maintaining profitability.

The Sandwich Portfolio Dashboard delivers comprehensive data visualization, real-time metrics, and highly customizable asset classifications, all designed to streamline portfolio management.

Loaded Accounts

*Only loaded account totals will be included in the Portfolio Dashbord views.

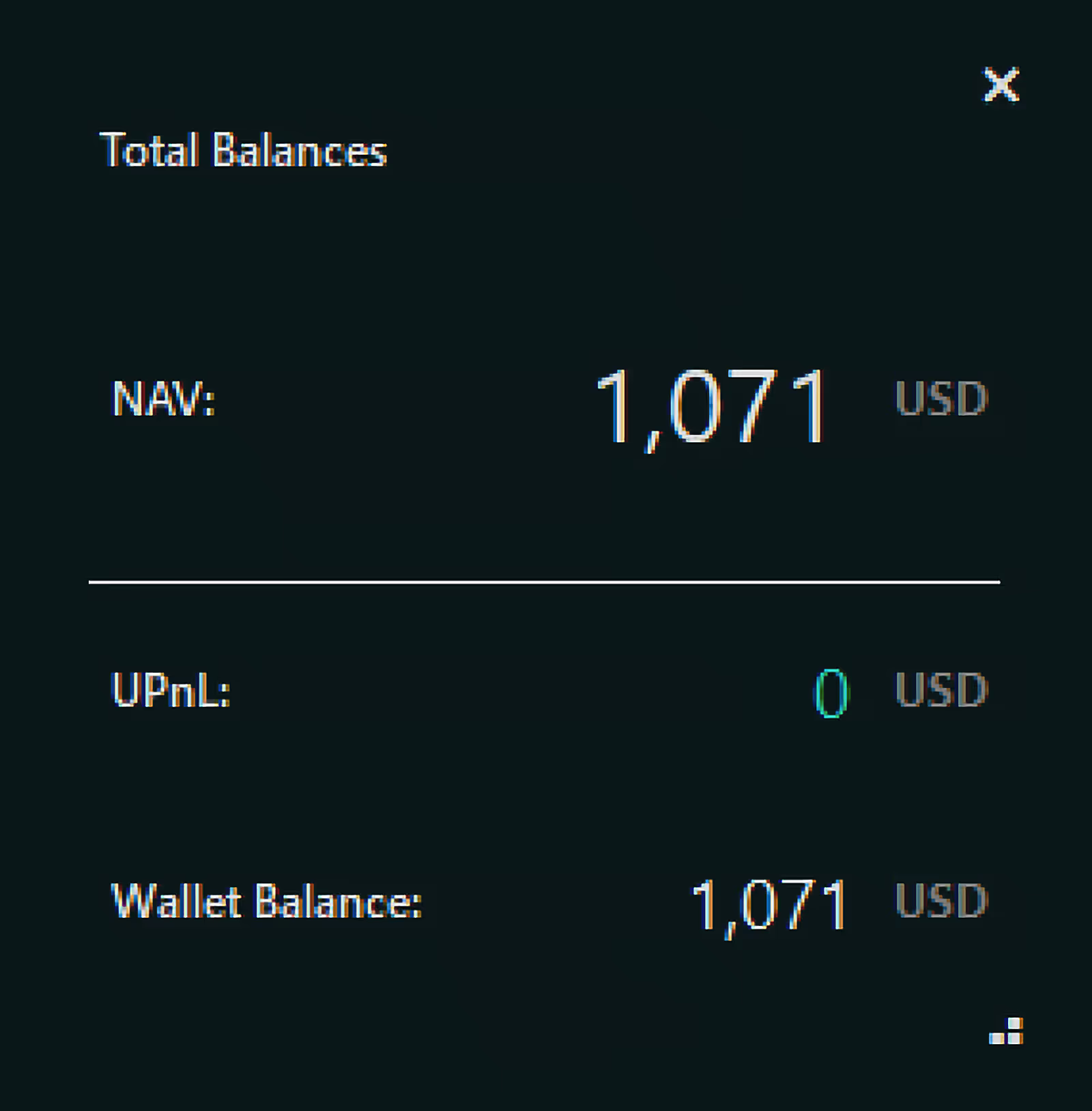

Total Balances

NAV

UPnL

Wallet Balance

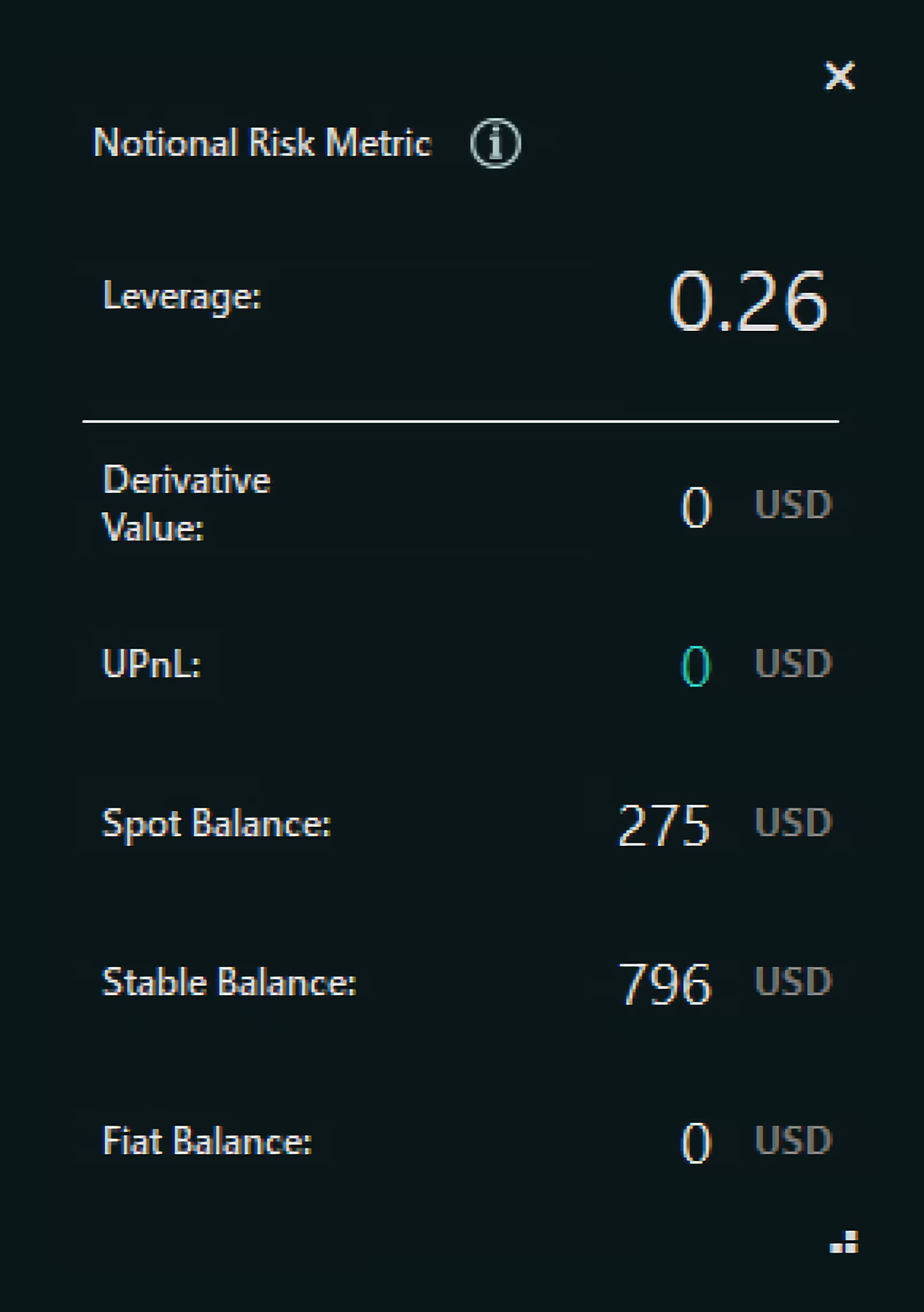

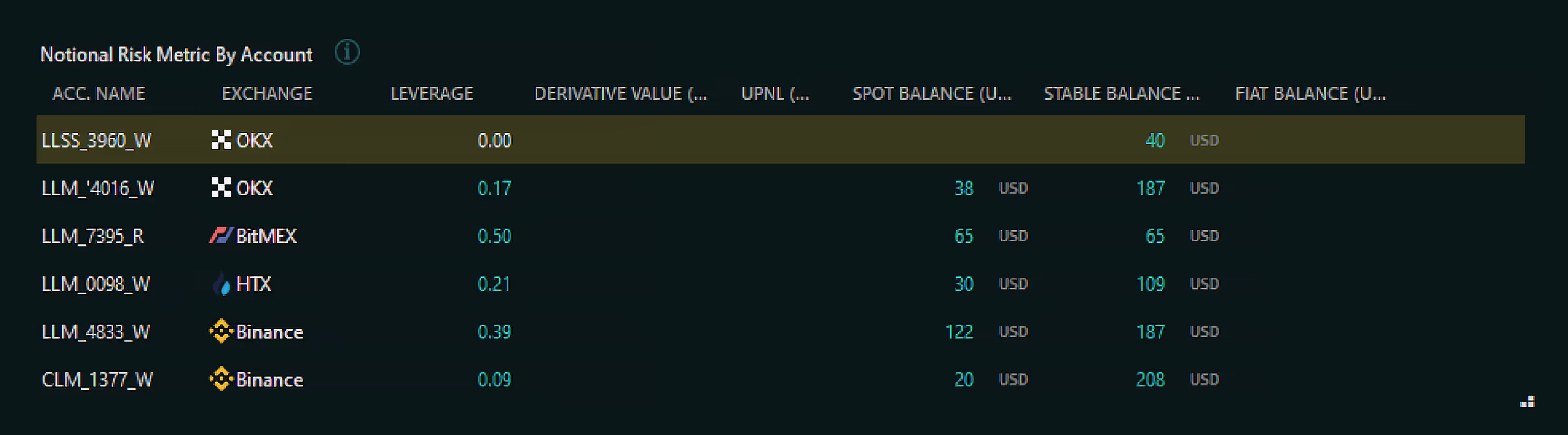

Notional Risk Metric by Account

The Notional Risk Metric is a customized metric utilized by Sandwich to evaluate a portfolio's exposure to cryptocurrencies, excluding stablecoins.

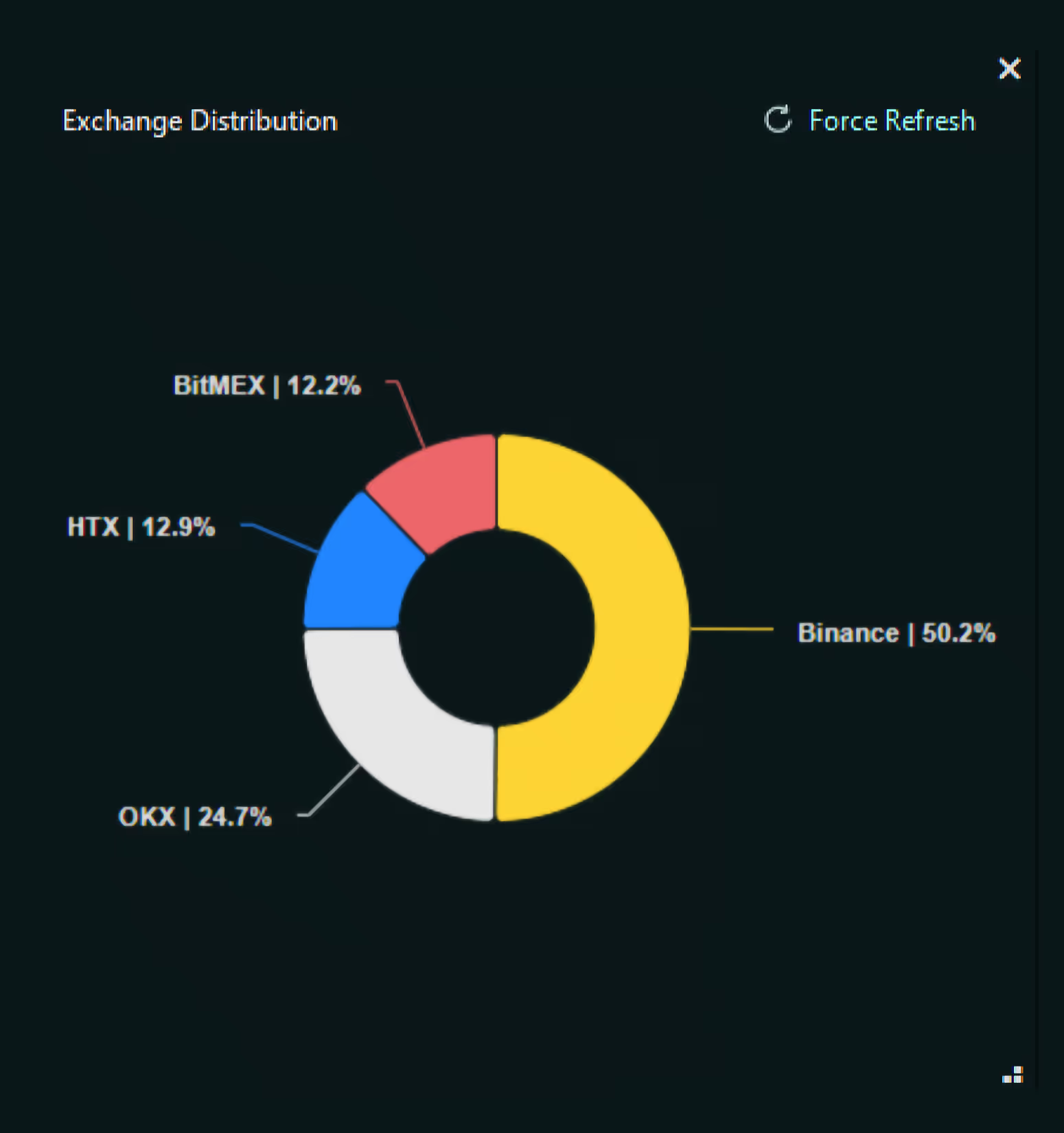

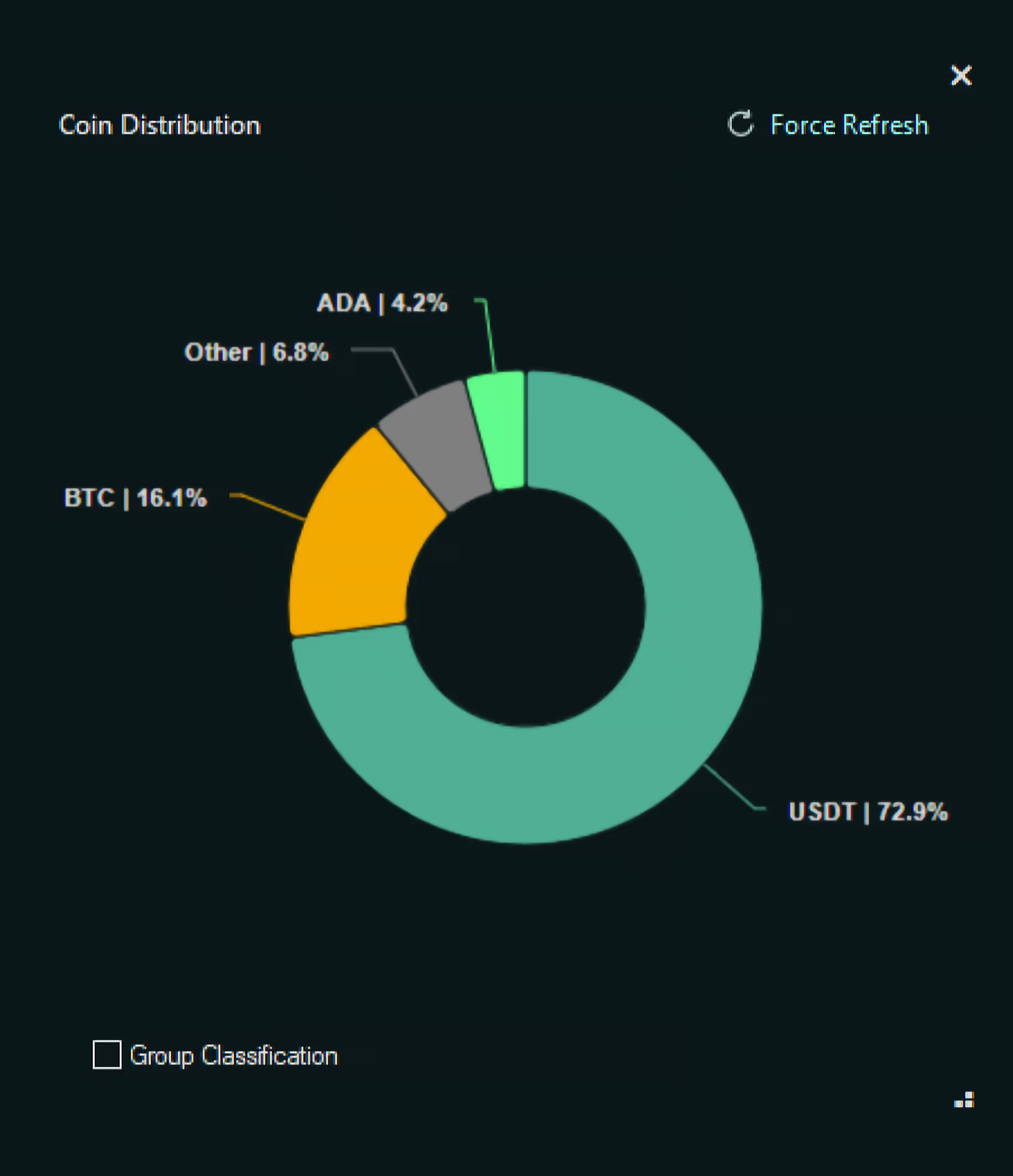

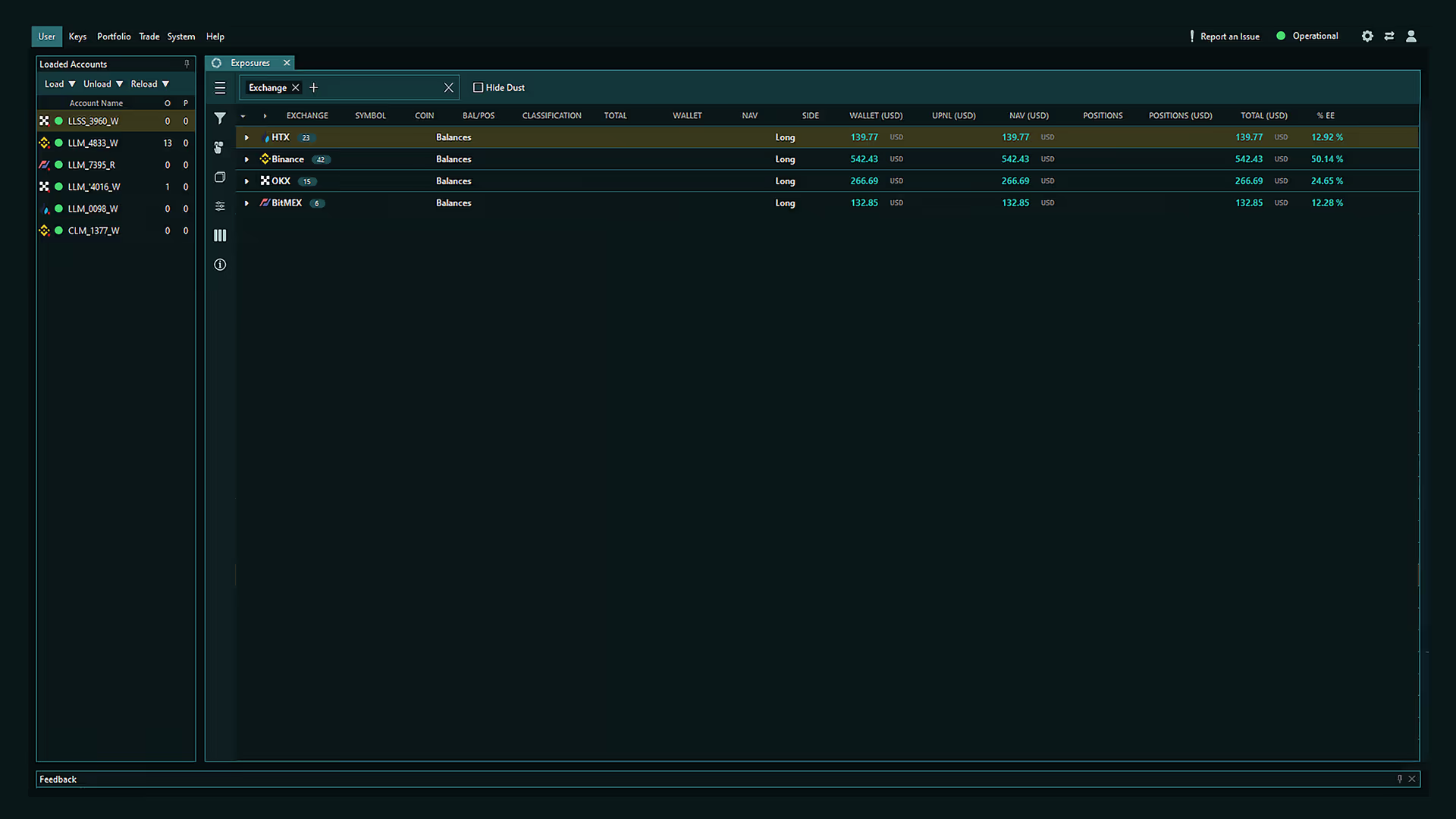

Exchange / Coin Distribution

Clear visual representation for quick, at-a-glance insights.

Notional Risk Metric

Understand where your assets are and where your risks lie.

Leverage: Monitor the amount of borrowed capital leveraged in your trades.

Derivative Value: View the total value of your positions in derivatives.

UPnL: Unrealized profits or losses of your current positions.

Spot Balance: Monitor crypto holdings in your portfolio.

Stable Balance: See your stablecoin assets.

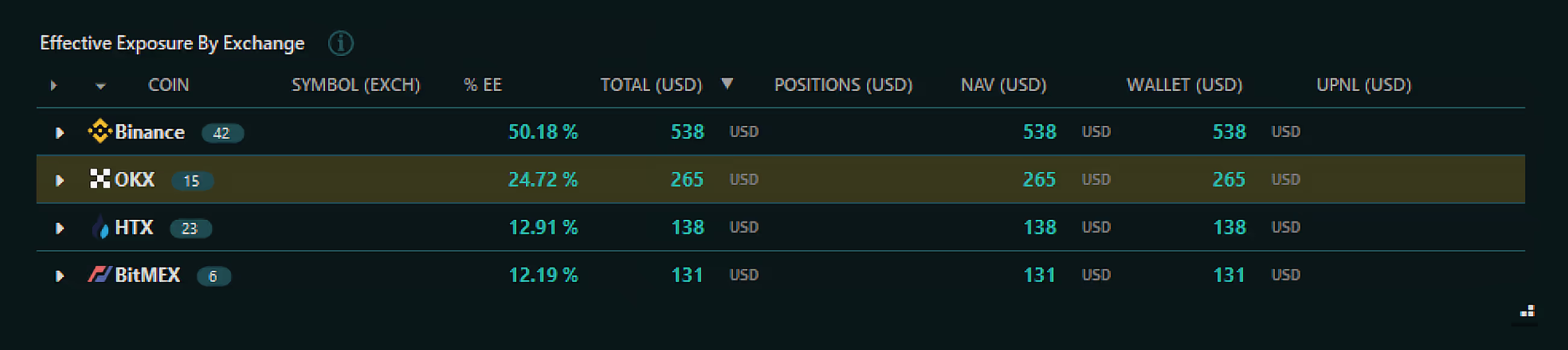

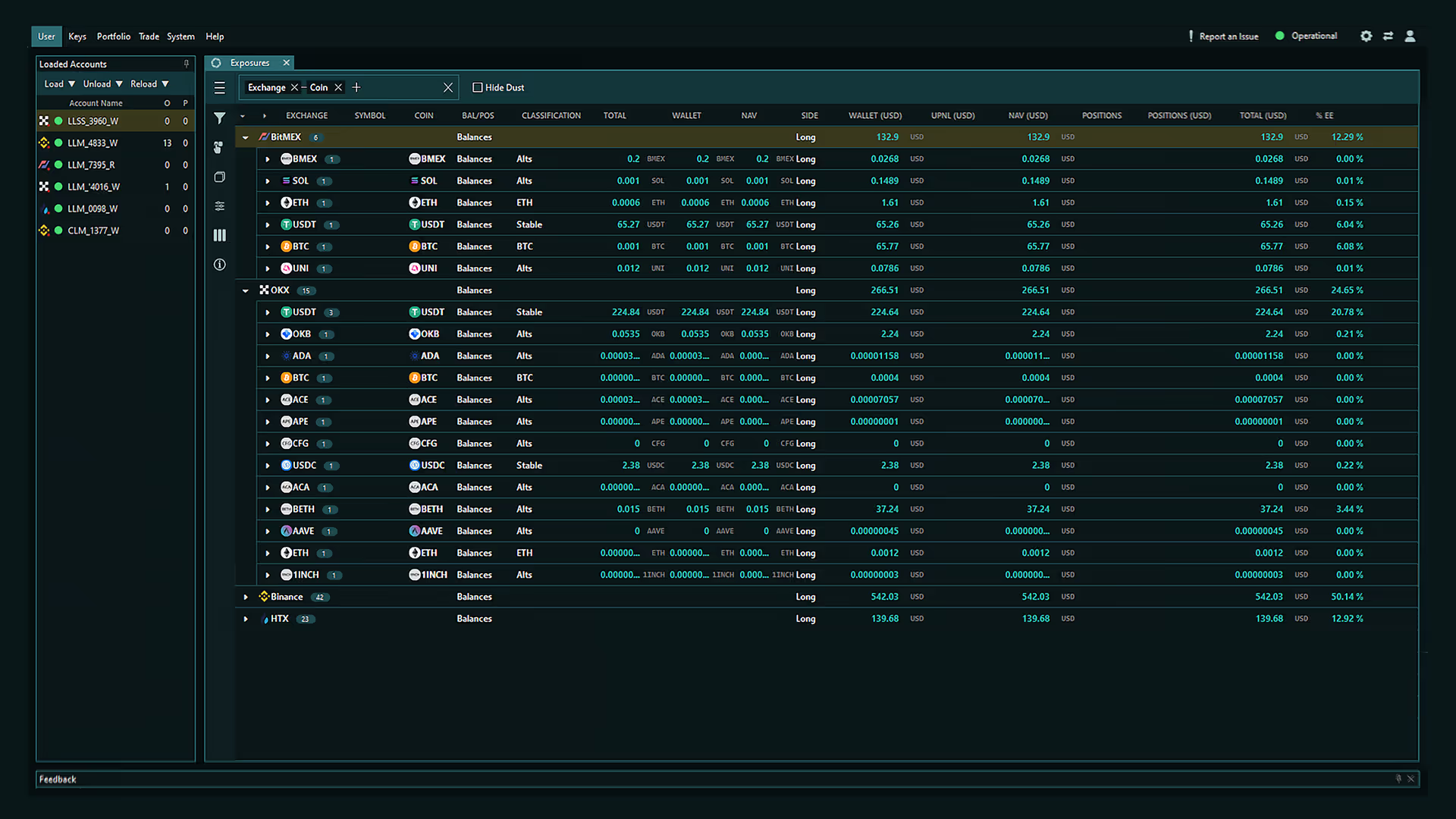

Effective Exposure by Classification / Exchange

Understand the market exposure you have based on the current value of your positions in different asset classes or exchanges.

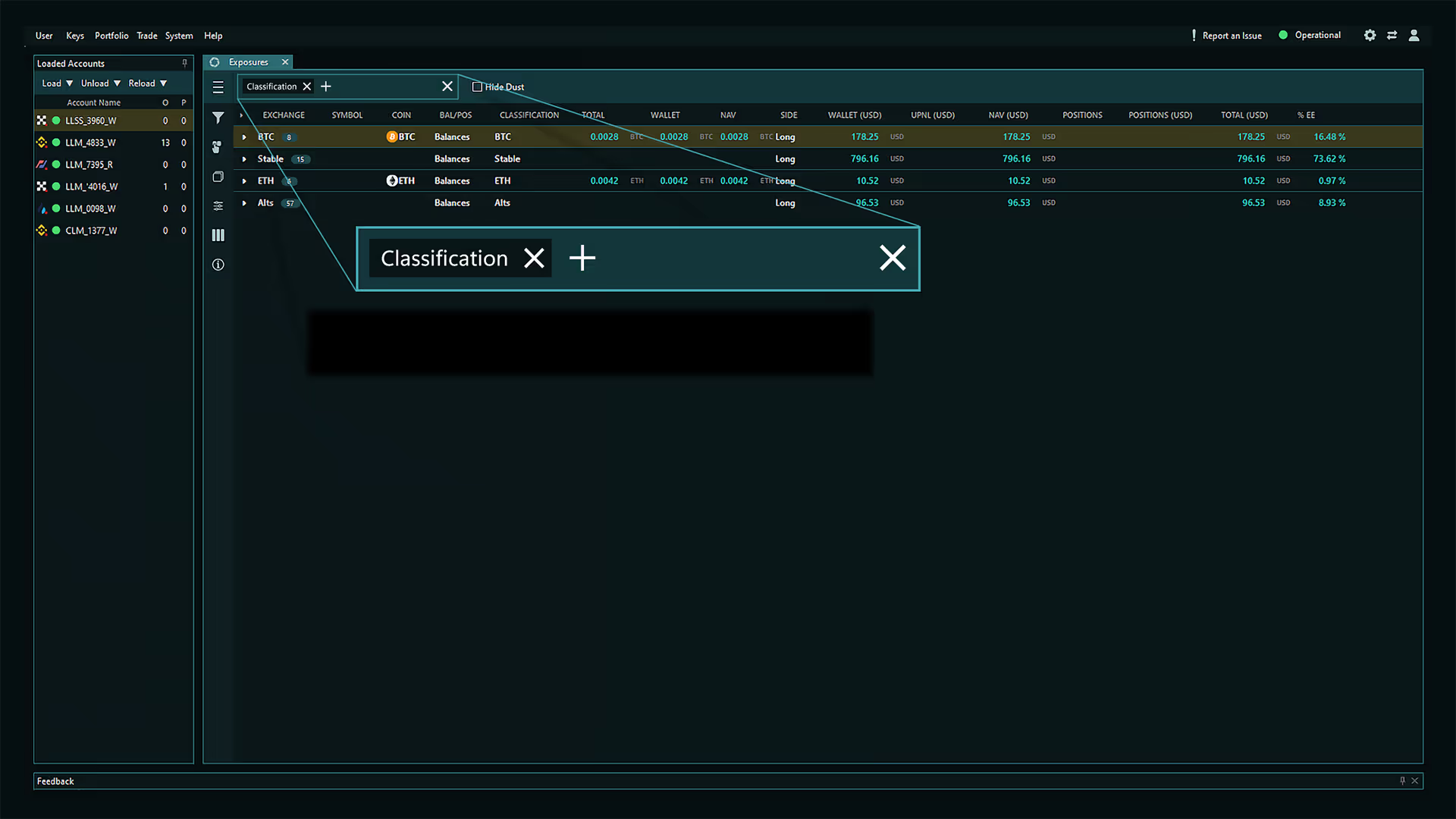

Exposures with Precision

Why Track Your Exposures?

By gaining a deeper understanding of your exposure, you can refine your trading strategy for improved performance.

Adapt your strategy proactively and stay ahead of the curve.

Uncover patterns and dependencies to refine your diversification strategy and minimize risk.

Track the volatility of your portfolio components over time and adjust your risk exposure dynamically.

Seizing opportunities or adjusting your positions in response to market fluctuations.

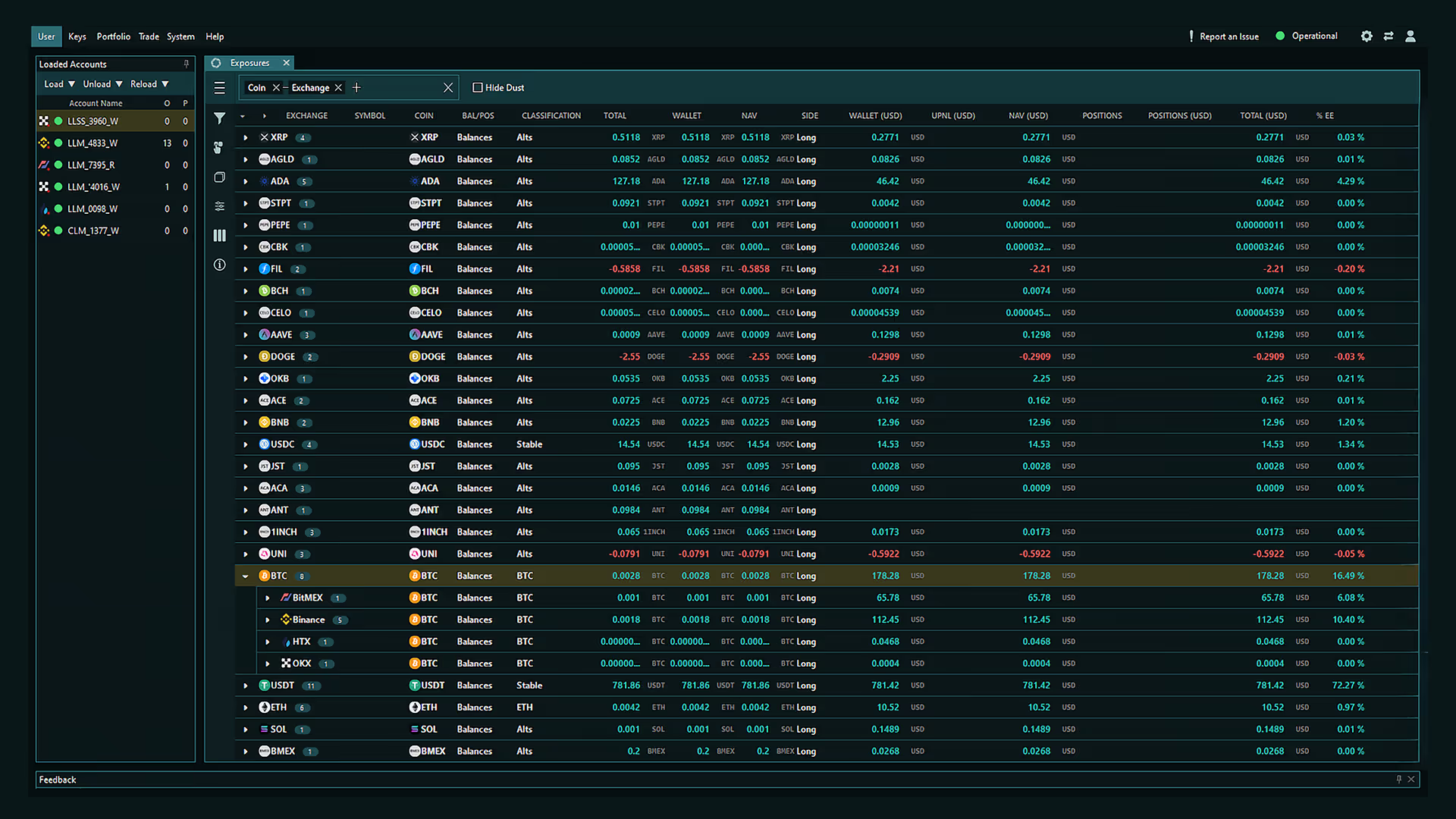

Gain granular insights into the distribution of your investments across different coins.

Identify potential vulnerabilities and diversify strategically.

Benefits of Exposures in Sandwich

Immediately identify where you might have too much risk in a particular coin or exchange.

Rebalance your portfolio across different classifications to better align with your trading strategy.

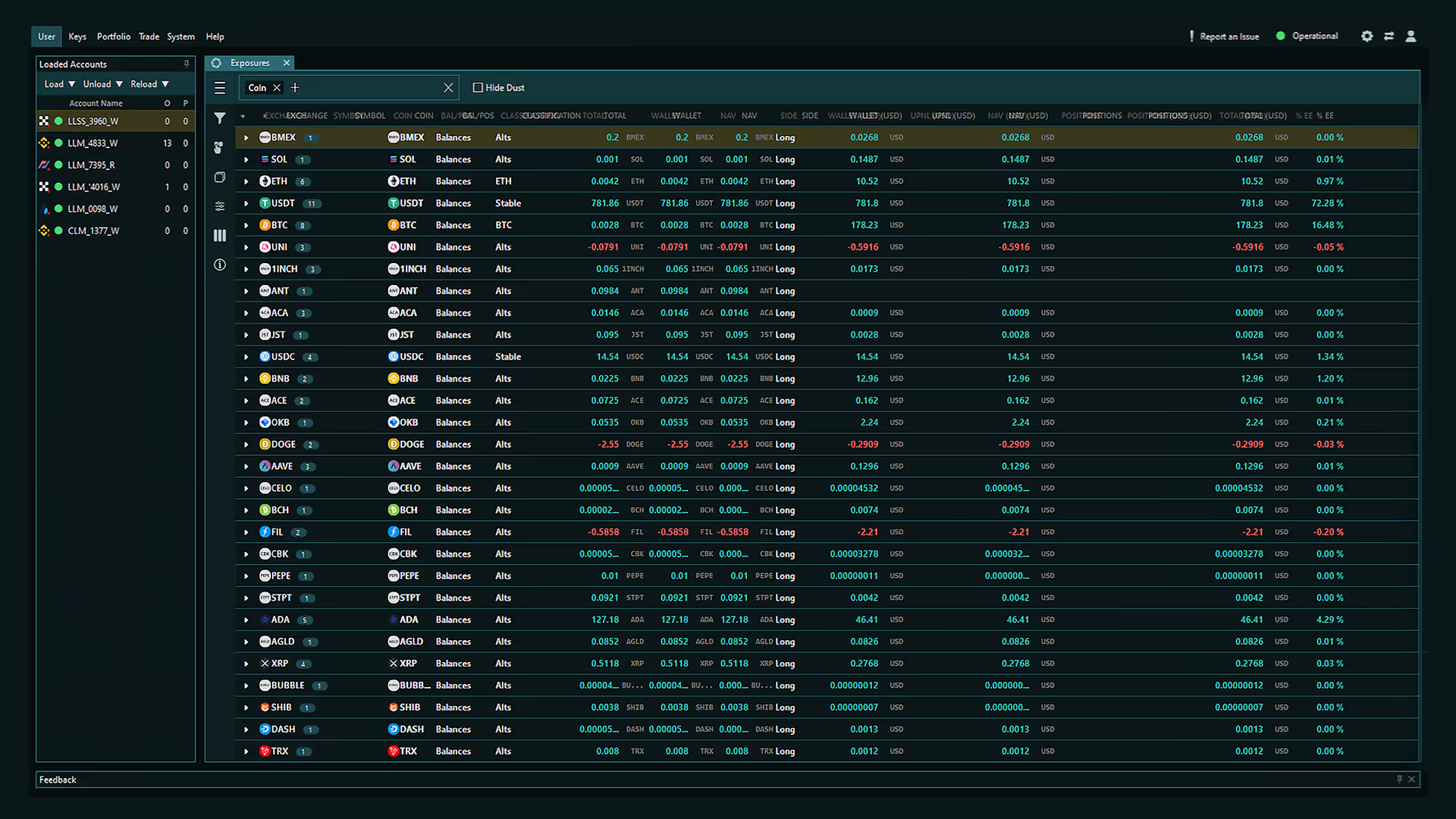

Advanced Exposure Tracking Features

Group assets into categories like Stable, BTC, ETH, and Alts. This allows you to monitor risk distribution and diversification across different types of assets.

Review your exposure based on the specific cryptocurrencies you're holding, whether it’s large-cap assets like Bitcoin (BTC) or smaller altcoins.

Instantly see how much you’re holding on each platform (e.g. Binance, Bybit, OKX, etc.), helping you manage your positions across different trading environments.

Complete Portfolio Integration

All of your exposures are integrated directly with your overall Portfolio Dashboard, meaning you don’t need to switch between multiple interfaces to understand how individual trades fit into your larger strategy.

Increase in trade execution

Reduction in trading errors

Trading capabilities

Time and price-based triggers lead to actions.

Get started with Sandwich in under 5 minutes.

No subscriptions, no contracts, only 0.01% per order.